Calculating implied volatility currency option price

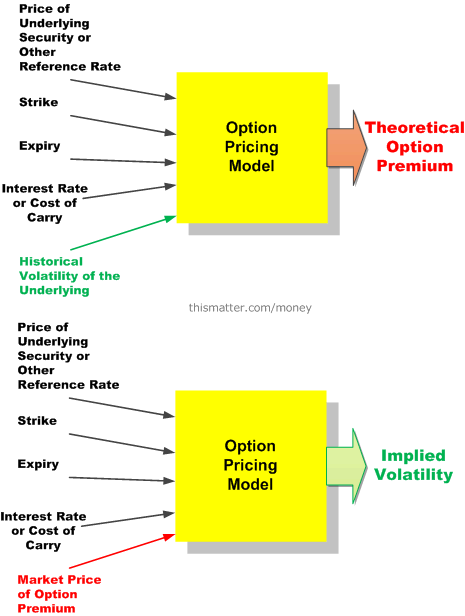

Implied volatility is a parameter part of an option pricing model, such as the Black-Scholes model , that gives the market price of an option.

The implied volatility shows where the marketplace views where volatility should be in the future. Since implied volatility is forward-looking, it helps to gauge the sentiment about the volatility of a stock or the market. However, it does not forecast the direction in which an option will be headed.

Implied volatility - Wikipedia

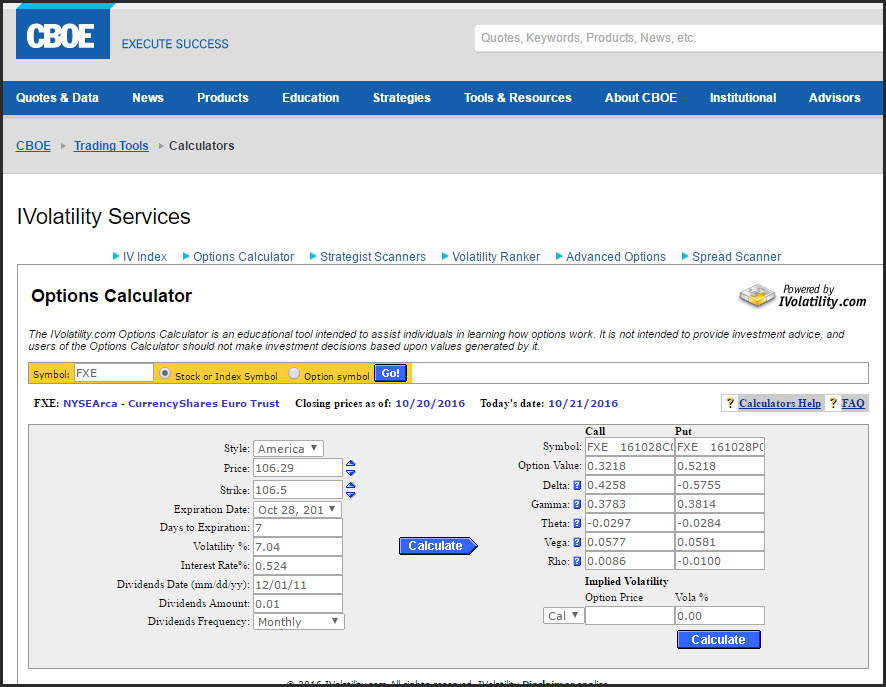

Implied volatility is not directly observable, so it needs to be solved using the five other inputs of the model: The implied volatility is calculated by taking the market price of the option, entering it into the B-S formula and back solving for the value of the volatility. There are various approaches to calculating the implied volatility.

One simple approach is to use an iterative search, or trial and error, to find the value of an implied volatility.

Historical vs. Implied Options VolatilitySuppose that the value of an at-the-money call option Walgreens Boots Alliance, Inc. The implied volatility can be calculated using the B-S model, given the parameters above, by entering different values of implied volatility into the option pricing model.

For example, start by trying an implied volatility of 0. Since call options are an increasing function, the volatility needs to be higher.

This procedure can be done multiple times to calculate the implied volatility. In this example, the implied volatility is 0.

The ABCs Of Option Volatility

Historical volatility , unlike implied volatility, is realized volatility over a given period and looks back at past movements in price. One way to use implied volatility is to compare it with historical volatility. From the example above, the implied volatility in WBA was Looking back over the past 30 days, the historical volatility is calculated to be Comparing this to the current implied volatility, it should alert a trader that there may be an event that can affect the stock price significantly; this could be a news event significant enough to elevate the implied volatility relative to the historical volatility for the past 30 days.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

The ABCs Of Option Volatility

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What is an option's implied volatility and how is it calculated?

By Steven Nickolas March 25, — 1: Learn how implied volatility is an output of the Black-Scholes option pricing formula, and learn about that option formula's Learn about two specific volatility types associated with options and how implied volatility can impact the pricing of options.

Learn what the relationship is between implied volatility and the volatility skew, and see how implied volatility impacts Learn how implied volatility is used in the Black-Scholes option pricing model, and understand the meaning of the volatility Learn why implied volatility for option prices increases during bear markets, and learn about the different models for pricing Discover the differences between historical and implied volatility, and how the two metrics can determine whether options sellers or buyers have the advantage.

Learn about the price-volatility dynamic and its dual effect on option positions.

Calculate Implied Volatility in Excel

Selling a greater number of options than you buy profits from a decline back to average levels of implied volatility. Even if the risk curves for a calendar spread look enticing, a trader needs to assess implied volatility for the options on the underlying security. The reverse calendar spreads offers a low-risk trading setup that has profit potential in both directions. Learn about stock options and the "volatility surface," and discover why it is an important concept in stock options pricing and trading.

The measurement of an option's sensitivity to changes in the A statistical measure of the dispersion of returns for a given An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.