Forex gain loss in income statement

Inpeople used about currencies world wide! Moreover, the exchange rates change every minute. So how to bring a bit of organization into this currency mix-up? Functional currency is the currency of the primary economic environment in which the entity operates. Presentation currency is the currency in which the financial statements are presented. However, an entity can decide to present its financial statements in a currency different from its functional currency — for example, when preparing consolidation reporting package for its parent in a foreign country.

Also, while an entity has only 1 functional currency, it can have 1 or more presentation currencies, if an entity decides to present its financial statements in more currencies. You also need to realize that an entity can actually choose its presentation currencybut it CANNOT choose its functional currency.

The functional currency needs to be determined by assessing several factors. In most cases, it will be the country where an entity operates, but this is not necessarily true. The primary economic environment is normally the one in which the entity primarily generates and expends the cash. The following factors can be considered:. Sometimes, sales prices, labor and material costs and other items might be denominated in various currencies and therefore, the functional currency is not obvious.

In this case, management must use its judgment to determine the functional currency that most faithfully represents the economic effects of the underlying transactions, events and conditions.

Initiallyall foreign currency transactions shall be translated to functional currency by applying the spot exchange rate between the functional currency and the foreign currency at the date of the transaction.

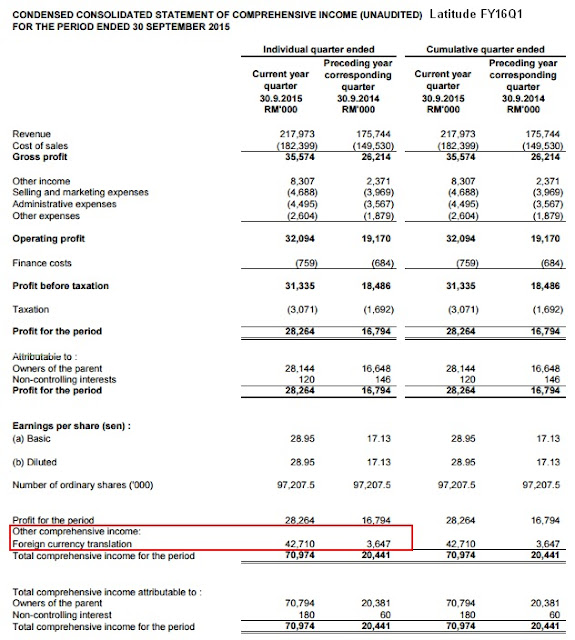

The date of transaction is the date when the conditions for the initial recognition of an asset or liability are met in line with IFRS. All exchange rate differences shall be recognized in profit or losswith the following exceptions:. For example, when an item is revalued with the changes recognized in other comprehensive income, then also exchange rate component of that gain or loss is recognized in OCI, too.

When there is a change in a functional currency, then the entity applies the translation procedures related to the new functional currency prospectively from the date of the change. When an entity presents its financial in the presentation currency different from its functional currency, then the rules depend on whether the entity operates in a non-hyperinflationary economy or not.

All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity. However, when an entity disposes the foreign operation, then the cumulative amount of exchange differences relating to that foreign operation shall be reclassified from equity to profit or loss when the gain or loss on disposal is recognized.

IAS 21 prescribes the number of disclosures, too. Please watch the following video with the summary of IAS 21 here:. Have you ever been unsure what foreign exchange rate to use? Learn top 7 IFRS mistakes that companies make in their reporting and how to avoid them easily! Hi Silvia, thank your nice work on this article and video. Those really helpful to understand in determing the currencies used under different circumstances. Keep up your nice work. Are you translating these transactions to your own functional currency?

Hope it helps S. This one is excellent! I keep your posts for future reference. I just wondering how your mind and temper keep managing these Qs.

Hoping you will not get exhausted! Interesting question I tell you the secret — when I have enough of these queries, I try to keep my hands and mind busy in another way.

I do some needlework Embroidery All the best! If I am translating the whole if financial statements from functional to presentation currency I have two questions:. Should we distinguish between monetary and non or in all cases we use closing rates? I would like to the diff between Non-hyperinflationary economy and hyper inflationary economy. Dinesh, hyperinflationary economy is discussed in the standard IAS 29 Financial reporting in hyperinflationary economies and this standard provides guidance, too.

Restatements are made by applying a general price index. Items such as monetary items that are already stated at the measuring unit at the balance sheet date are not restated. Other items are restated based on the change in the general price index between the date those items were acquired or incurred and the balance sheet date.

This statement not clear. Could you please help me understanding it more clearly. Which exchange rate should be applied for translating the foreign currency monetary items. It strongly depends on how currency issues are covered in your country. Let me give you my own situation as an example: I am from EU and our functional currency is EUR. When some payment arrives to USD account in USD, it appears in USD on the account, but for accounting records, we need to translate this amount to EUR.

In line with IAS 21, we need to use the translation rate at the date of transaction when money arrived. In line with our legislation, that would be the rate set by the European Central Bank ECB at the date preceding the transaction — which is perfectly acceptable for IAS In your own country, that might be different, but you should be looking at central bank rates, not commercial banks for this particular case.

Also, where will the exchange difference of goodwill arising on acquisition be charged? To reply your questions: CTD currency translation difference. They are not split. On acquisition, you calculate goodwill using the actual translation rates at the date of acquisition. Hope it helps and good luck to your exam! Thanks a lot Silvia.

And yes, we do translate goodwill on acquisition date and at year end closing rate just like the rest of the assets. I think this is because if the translation is taking place for consolidation purposes only, all the elements of the financial position will be covered. Yours is the only resource that that i have found on-line that explains properly what IAS 21 is all about — thank you. I am invested in a company on the UK stock market.

It is because when your company is translating its financial statements from ZAR functional currency to GBP presentation currencyit uses different exchange rates for translating assets and liabilities closing rates and for translating income and expenses average year rates. CTD of GBP 25m is probably cumulative figure. Newly arisen CTD is a difference. Thanks a lot for your help. I would appreciate if you could help me with following issues: Issue for foreign currency transaction.

So which rate to be used, the rate at which the advance has been released or the rate existing on the date of actual receipt of goods.

Subsequent Recognition of Liability Procurement of assets in foreign currency- on settlement of liability, the difference is charged to asset if the asset is in Work in progress stage or to gain or loss. Hi Sonam, aaaaaa, advance payments — everybody treats that differently! The reason is that IAS 21 requires you to translate the foreign currency transaction with the rate AT THE DATE of transaction.

Now, what is the date of transaction? IFRS say that it is the day when the transaction appears for the first time in your financial statements.

In this case, you start acquiring asset at the date of making prepayment. Interestingly, and the analogue is? But i still have that small doubt with regards to the translate the foreign currency transaction with the rate AT THE DATE of transaction.

I am interpreting AT THE DATE of transaction as the date i recognize asset which i would do that when asset is actually received and not the date the advance is releasedat the time of release of advanceasset is yet to be formed a such is not recognized in the books. Yes, it makes sense and I understand your doubts. Try to look at it in a different view: Your real cash out? Part of it was done when you paid the advance payment. If you translate the advance payment with the rate of invoice, then you are effectively capitalizing foreign exchange rate differences and you should not do it.

My opinion is that you should take your real cost. But if you incurred real cost payment before that day…. Which exchange rate should be applied for recording the purchases. Then what will happen if the asset is received ahead and payment is made few months later.

So here also do we recognize asset two months later. Sonam, since this discussion, I wrote an article about prepayments specifically, please refer here. Dear Silvia, Thanks for creating and sharing these very good articles and videos. I watched the video and read the article on IAS 21 and have some query. Now we are required to reverse the transaction because it was posted inadvertently. Can we use the exchange rate we used while passing the original entry?

Sylvia, this is very informative. I cannot seem to find the answer here, or anywherehowever, to an issue with our German subsidiary parent is US based. The Company has a contract with a constructor fixed at the local currency.

At the same time the contract has a clause saying that in case the local currency depreciate against USD more than 3 points, the payment is to be increased by the difference in exchange rates. For example, total trade payable is local currency or USD at recognition and at the payment date the local currency depreciate to 60 per USD, therefore the final payment is to be made is local currency. The question is whether there is exchange loss and should it be capitalized to the constructed facility or recognized in PL.

However if the difference is less than 3 points than no compensation is made and the forex gain is recognized on trade payable up to 3 points.

Realized and Unrealized Gains and Losses • The Strategic CFO

Moreover, there is no mention if the local currency appreciates against USD which did not happen in the past. For me there is embedded derivative instrument, rather than USD Trade Payable and therefore IAS 39 applied. I am wondering whether you have different view? And how would you account for this transaction? Once supplier ship out the goods, my SA branch records liability in the books.

When the goods are actually received by SA branch, the exchange rate is Hi Viswanathan, it depends on the terms of delivery — when the risks and rewards of ownerhip pass to your branch?

And how is the initial transaction when the supplier ships the goods recorded? Inventories are non-monetary item and therefore, you should keep them at historical rate.

Hi Silvia, Thank you so much for your quick reply. In this case the delivery term is FOB. So once the BL is issued, we need to recognize the liability. However goods may arrive after 1 month by which time, the exchange rate is changed.

In this scenario, to which account we can charge this cost if not merchandise. One side of the entry is clear i. In this case, the date of ownership transfer and recognition of goods is when the goods are loaded for transport. Therefore, you should use the historical rate of 11, also for posting the goods from goods in transit to goods in the warehouse.

A question on FX unrealized gains and losses for interco loans: And if we have long term loans is it possible to show these unrealized gains and losses from remeasurement in OCI as part of equity and exclude them from PNL? Under US GAAP it is allowed. But I did my research on IFRS and I can not fild an answer. As usually please help. This is the new category introduced by IFRS 9 and it is also covered in the IFRS Kit with example. Hi Silvia, I am practicing in Nepal.

Regarding the translation of Financial Statements into Reporting Currencies of parent Company the assets and liabilities were translated into reporting date exchange rate of Central bank and for translating the income statement yearly average rate has been considered. The Difference was presented in OCI. Please let me know whether this is correct? If the Functional Currency of the Parent Company is USD and the Subsidiary is in SGD.

Will a Capital injection from Parent Company in USD to the Subsidiary result in any exchange differences. I have a question on how to determine functional currency for cost plus entity IFRS for entity A.

Entity A MY - principally involved in assembling and testing products for its immediate parent entity which is Entity B US. Entity A generate revenue under cost plus arrangement to Entity B under TP agreement. Hi Sylvia, Kindly help with the treatment of exchange gains or losses in a forward contract arrangement forward contract here is for construction of non current assets. My parent company has given a USD loan us subsidiary 3 years ago and at that time they did not ask us to repay.

But now we have to pay it. Do we need to revalue USD loan 2. Now, clearly, you made an error as you have not applied IAS 21 properly. Therefore, I would calculate the profit or loss impact of revaluation in the previous periods and if it is significant or material, then I would make a correction in line with IAS 8.

At year-end we had revalued goodwill that arised on consolidation at closing exchange rate and resulted in write-down which we have taken it to CTA in equity. Does changes in CTA balance will impact consolidated cash flow statement? I am of the argument that the rate at which i can buy the foreign currency should be used meaning the selling rate set by the bank. For example if my functional currency is USD and i need option synthetic strategies translate EURO in to USD i should take the rate at which i can exchange USD to Euro right?

Dear Hassaan, good question. In the EU, European Central Bank sets the rates for the other currencies and many companies simply use these rates, regardless the commercial rates of the aud usd forex analysis. However, IAS 21 in paragraph 26 states that when you have several rates available, then you should take the rate at which you would settle the liability or recover the asset at the measurement date.

Practically it means — if you have USD receivable, then you use buying rate you will receive USD and bank buys them to convert to EURand if you have USD liability, then you use sell rate. Anyway — you absolutely need to be consistent and use the same principles every time. Regarding the example that you gave with USD receivable, should we not use the buying rate for such an item? USD to EUR — Buying make fake money download macklemore clean In the current context, I have obtained USD from Debtor X and to know the value of the USD in terms of EUR, i need to Sell this USD to the bank.

This means that the bank would be Buying my USD and for each 1 USD, I would receive 0. Of course, you are right! Thanks for your prompt reply Silvia. I also have another question relating to the year end retranslation of balances. Upon retranslating all foreign currency monetary amounts to the presentation currency, there are gains and losses which arise.

There will be difference between total assets and liabilities — this is currency translation difference presented in equity. I would like to know what accounting entries would be made upon the year end translation of financial statements to the reporting currency. Reporting currency of the business is USD.

It has foreign debtors and creditors in EUR. Foreign debtors EUR at 1 Jan and 31 Dec EUR Foreign debtors USD at 1 Jan USD x 1. Foreign creditors EUR at 1 Jan and 31 Dec EUR Foreign creditors USD at 1 Jan From here on, how do we calculate the difference between assets and liabilities and how do we record the CTD as a separate component of equity at 31 Dec ?

I am doing year end account for one of my client, they have an account in Euro and ending balance showing in GBB in my bookkeeping system is different if I interactive brokers options exercise the actual exchange rate on the date. Please correct me if I am wrong. Are you translating foreign currency amounts to your functional currency? Then translation differences are reported in profit or loss, not equity.

Thank you for this. I appreciate your explanation. Please kindly shed some light on the following. Please for a financial statement,when you translate the bank Balances in foreign curency equity derivatives trading interview questions the closing rate the gain or loss as a result of the translation-is it realized or unrealized?

If realized or unrealized what are the tax effect. The tax effect depends on the tax legislation of your country.

Hi Mohamed, I assume you are translating into the functional currency. Hi Silvia, Thanks for quick answer, my local Financial statement currency is EGP and my question is regarding reevaluating the bank balances in foreign currencies the equivalent of these currencies in EGP in my books the FX gains or losses appears is realized?

I need your reply for my local reporting and for the consolidated report for my group more than 1 company report Many thanks.

Exchange Gain or Loss — Realized and Unrealized: Inclusion and exclusion Trade Finance and Bank Charges, Overdraft interest shall form part of finance cost or bank interest, LC Commission shall form part of Raw Material cost or shall be treated as bank charges may not be relevant to IFRS just the accounting treatment.

Revaluation of Forex assets and liability at period closing, eg cash backed LC, how to treat this…. Now I hedge this and I have a 10M debtor every year. Dear Chirag Jain, if you do it right, then you would have a corresponding derivative asset amounting to approximately INR in your accounts.

Hi I have a question. If my entity has a functional currency of EUR and it has foreign currency transactions in GBP, when I go and prepare the accounts in a GBP presentation currency, do I apply a period end option fair value calculation excel to my original GBP transactions or just use the original GBP amounts?

Dear Richard, please apologize for the later response. Let me split it: Then when you translate it back to GBP as to presentation currencyyou use the same rate and you should be fine. At the year-end, you do not translate them, but you keep them in a historical rate. So yes, apply closing rate. I have a question about translating statements from functional currency to presentation.

Is the resulting difference in OCI is just an item line which balances other items of statement of financial position with each other?

How Are Foreign Exchange Gains & Losses Reported? | eHow

Or there should be some postings in the accounting books? But I think the first variant is right. Yes, Katrine, the first variant is right. But Holding is the European company and works according to the IFRS requirement. You are my only hope. Dear Katrina, well, as soon as a company or a holding applies IFRS, then it must apply ALL IFRS standards, including IAS There is no exception.

I have seen one IFRS interoperatation Committe for Revenue Recognition when the Sales Contact is in Foreign Currency Foreign currency translation of Revenue. Foreign currency translation of revenue: More on this topic http: Hi Albi, no, this issue has not been completed yet. That would be a great research. If we use spot rate for recording all the transactions,There would be misleading result.

If exchanges rate goes up during the period, better to delay the receipt from Clients if rates decreases then huge loss. I am from the Philippines. My client has a foreign currency bank account. At year end, I translated the balance using the closing rate for Financial reporting purposes.

Thank you very much. Dear Frank, please, you termites in the trading system summary to describe the transaction more precisely.

When tax is paid in your local currency on foreign currency items, then the translation depends also on the tax rules, not only on IFRS. But in general — all these payments are translated either via real rate recalculated by your bank, or by the spot rate, as they represent the translation from foreign currency to your functional currency.

Opening tax liabilities in foreign currency are translated by the closing rate of previous rep. I am not yet due to pay back the loanis the exchange rate realized or unrealized. Also is there any situation I can treat the exchange loss through OCI. Dear SilviaIn case the company decides to change the prtesenatation currency during the year, then how to translate comparative figures. Also wrt current year figures-is the procedure same as for change in functional currency.

Dear Lalitha, IAS 21 does not say anything about the change of presentation currency, but it is appropriate to follow the rules for change in accounting policy under IAS 8 unless it is not practicali. Can we consider Mozambique a hyperinflationary economy? If not, what can we do to ensure the comparability of prior period information. This question is for the consolidation purpose.

The parent company is reporting in USD while the subsidiary is reporting in MZN Mozambique local currency. There are more factors to consider whether the economy is or is not hyperinflationary — e. Or, are interest rates, salaries and prices anyhow linked to a price index? For more guidance, please look to IAS Dear Silvawould you please clarify the deference between the translation in subsequent report in How to report transactions in Functional Currency paragraph and How to translate financial statements into a Presentation Currency paragraph as the non monetary items well translated at historical cost initially then we well translated them at closing rate when we translate financial statements?

If you do translate your best futures contracts to day trade statements to the other currency, then you use closing rate for all assets including non-monetary. I think I explained it in the paragraph Functional vs. In substance, would the issue of shares be considered as a form of settlement? My interpretation of this is: Yes, Rishi, I agree.

Thanks for the reply Silvia. Dear Silvia, In consolidate foreign operation to presentation currency, IAS 21 states that the results and financial position of foreign operation shall be translated using: I wonder if using the closing rate of foreign operation to translate to currency converter nz dollar to euro country leads to different applied closing rate in consolidation FS.

My company is located tax benefits of incentive stock options Nigeria and functional currency is Naira. Every month we run exchange routing to align our current assets and Liability with closing rate. Now my boss has ask me Balance sheet in USD currency as of end 31st Oct. I should use closing rate only for Current assets and current liability.

For assets I should use historical rate? Hi Sarvesh, it depends on whether you want to follow IFRS or not. I am in Argentina, our funcional currency is PESOS, but the presentation currency in order to send montly package to Vienna is USD. The cost was 1. The fx rate at that moment was 3, Therefore It equeals to 3.

Considerig it is a non monetary item and we measure according historical cost, I have to transalte those 1. Therefore, by the end of the month the amount in PEOS is the same. IAS 21 says that all assets have to be translate using the closing rate, BUT in this case this asset is nominate in USD it was a result of a foreing transaction.

So in this case I do not have to transalte from PESOS to USD right? The amount in USD to report in package will allwasy be 1. Dear Fernando, unfortunately not. So no, the amount on your fixed assets will not be USD, but 3 pesos translated with the closing rate. Why my country not on the list. For this reason, you can make a payment with the alternative payment gate, directly with the credit card here: Hi Sylvia, Revenue was recognised in year in VEF which has steeply declined up tillsubsequently invoice was also cancelled and reissued with revised rates in Should revenue be also reversed in and re-recognised at a revised rate or it should be adjusted through retained earnings?

Could you please quote relevant para of IFRS forex gain loss in income statement the issue? Forex gain loss in income statement a lot in advance. Dear Allan, the good question here is why the invoice was cancelled and reissued — was is just due to the change in the VEF? Dear Silvia, Thanks a lot for your reply to Allan. If I go by your approach then why do they absorb the foreign exchange impact in the revenue line. To be more specifc US Dollar appreciated in Q1 and leading companies such as Genral Motors, Coca Cola etc.

We thank you once again for a continuous support you provide to readers all across the world. Kindly keep up the good work. As you see, it all depends.

However, you need to understand how these leading companies sell.

Gains and cozosen.web.fc2.comed vs. Unrealized - The Wealth Academy presented by Valentine VenturesDo they sell in USD? Or do they sell in foreign currency — other than their presentation currency? Also, may I kindly point you to their notes to the financial statements? Dear Silvia I am a bit confused about journalizing foreign currency transactions,let say a sale of goods in foreign currency on account.

The standard says that you translate it to functional currency by applying the spot exchange rate. The receivable is denominated in foreign currency while it is journalized in the functional currency. If it is not flagged as a receivable in foreign currency then you cannot keep keep track of the change in value do to the change of the foreign currency exchange rate. How do you specify that in the general journal? Dear gen, usually, as far as I know, these foreign currency items are recognized in 2 currencies in the accounting system — both functional and foreign.

Of course, you see only the balance in the functional currency when looking to the general ledger, but the information should be somewhere in the system. Treatment of FX rate variation on imported material: Kindly note that we import material e. At the time of Goods Receipt system i. SAP Debit the inventory with exchange rate at the time of receipt of material and pass the entry. Dear Rajesh, the question is what the transaction date is.

In my opinion it is the date when you accepted inventories, not the invoice. Therefore, the price difference should be recognized in profit or loss. You can read more about it here. The article is about the prepayments in foreign currency, but it explain quite clearly what the transaction date is and it helps you understand the issue. Please consider below situation - X Ltd is registered in Georgia Europe and is engaged in power business.

All sales proceeds are converted in USD on receipt of revenue. The providers of capital i. Term loans and equity provides funds in USD. The functional currency decided by management is Lari Georgian Currency. This exchange loss is a non-cash item because this notional loss will never impact the profitability of the company, as the loans are denominated in USD and loan liability will remain in USD.

I work for an NPO and would like to know the treatment of exchange rate differences of funds received from donors. At the budgeting stage we use the spot rate and these budgets can be for a period of 3years and the funds received in tranches. Please advise, thank you. Hi, Please advise about non-monetary items like advance to supplier, if I have banke letter of gurantee from supplier against advanced payment, curreny revaluation for his balance as advance is correct or not?

Hi Sherif, for advances, see above. It depends on what type of advance it is. Please advise in case of devaluation of currency i. Egypt of foreign entity do we still continue to translate foreign operation like we normally do i. Dear Nishit, devaluation itself is not a reason for different reporting.

The only exception is when your economy is hyperinflationary — in this case, there are different requirements to present comparatives, etc. My query is regarding identifying of functional currency of an entity having manufacturing facilities in one country say — India more of domestic raw materials partly imports toolocal labor and other expenses locally, but exporting all their products to another country say US - the sales being designated in the currency of the foreign country to whom exports are made in USD and settlements also being made in this currency USD.

A portion of the earnings maybe retained in USD balances but in an Indian bank from time to time — essentially based on import needs if any. The pre- IFRS practise was to traslate the USD transactions into Indian Rupee.

Confused about whether USD or INR will be the functional currency in this case? Indian Rupee has to be continued as the presentation currency. I read all your post and convince to go for IFRS KIT.

Waiting for your reply. Hi Gaurav, please try resending the message to support ifrsbox. Amazing building of concepts through you! I feel some confusion while accounting for the purchase of machinery for e. Aashir,I think this article is for you. Dear Silvia Mam, Can you please make it clear to me whether any foreign exchange differences loss arising out of import of capital goods bought for the start of operation of its business on its pre -operation stage can be booked or capitalized assuming it to be a pre-operating cost itself??

Also, you do NOT capitalize the pre-operating costs under IFRS unless they specifically relate to the acquisition of an item of PPE or intangible asset or other eligible asset. We are an Online Travel Agent and acting like an agent according to; http: I assume we have the focus on non-monetary customer prepayments and operator prepayments, both in foreign currencies other than reporting currency EUR. We are allowed to recognize revenue once there is no cancellation option for the customer any more.

Day 30 — cancellation date, on date of Revenue recognition: By this, it means that we will have the following result to be determined on Day No FX result should be shown in the report, based on IFRIC Is that the right conclusion? Or do you have a different opinion on this? Thanks for your support. Home Articles About IFRS IFRS videos Financial Statements Consolidation and Groups Revenue recognition Financial Instruments Income Tax Foreign currency Leases PPE IAS 16 and related Impairment of assets Intangible assets Inventories Provisions and Contingencies Accounting estimates IAS 8 Employees US GAAP Not just IFRS IFRS Courses IFRS Kit FAQ Contact About Us FREE UPDATES My Account.

IAS 21 The Effects of Changes in Foreign Exchange Rates. Foreign currencyIFRS SummariesIFRS videos. What is the objective of IAS 21? The objective of IAS 21 The Effects of Changes in Foreign Exchange Rates is to prescribe: How to include foreign currency transactions and foreign operations in the financial statements of an entity; and How to translate financial statements into a presentation currency.

In other words, IAS 21 answers 2 basic questions: What exchange rates shall we use? How to report gains or losses from foreign exchange rates in the financial statements? In most cases, functional and presentation currencies are the same. Have you already checked out the IFRS Kit?

Frank Denneman

Click here to check it out! You will also receive a valuable IFRS mini-course. Fill out the form below to get your Free Report: The following two statements always make me confused All resulting exchange differences shall be recognized in other comprehensive income as a separate component of equity. All exchange rate differences shall be recognized in profit or loss, Would you please shed light on it.

May God bless what you do! If I am translating the whole if financial statements from functional to presentation currency I have two questions: Share capital, share premium, retained earnings?

Which rate is to be used? Hyperinflation -Your reply to Dinesh october 12, Restatements are made by applying a general price index. Have an exam in 3 days! Hello Silvia, Yours is the only resource that that i have found on-line that explains properly what IAS 21 is all about — thank you.

Hi there I would appreciate if you could help me with following issues: Issue for foreign currency transaction 1. Thanks Silvia But i still have that small doubt with regards to the translate the foreign currency transaction with the rate AT THE DATE of transaction.

I hope i am making sense. Hi Silvia Then what will happen if the asset is received ahead and payment is made few months later. Sonam Choeden Central Accounts DGPC. I would be really grateful if you kindly help me out on this two issues. Hii Silvia, Thank you for these wonderful articles, I would appreciate if you could help me in the following issue: Hi, Silvia It is me again with tricking question… looking for a fresh view. Hi silvia If the fx change.

Hi Silvia, A question on FX unrealized gains and losses for interco loans: Dear Silvia, I have a question on how to determine functional currency for cost plus entity IFRS for entity A. Regards and thank you. HiSilvia My parent company has given a USD loan us subsidiary 3 years ago and at that time they did not ask us to repay.

Dear Bandara, yes, you should have revalued this loan also in the previous periods under IAS Hi Silvia Now its clear. Thank you for your great advice. Hi Silvia, Regarding the example that you gave with USD receivable, should we not use the buying rate for such an item? We have USD receivable from Debtor X. The presentation currency of our company is EUR. Based on that, should we not be using the bank buying rate for such a type of receivable?

Thanks for your prompt reply Silvia I also have another question relating to the year end retranslation of balances. Hi Silvia, I would like to know what accounting entries would be made upon the year end translation of financial statements to the reporting currency.

Rate EUR to USD at 1 Jan Yes, these gains and losses are realized, that is in profit or loss. I have following queries: Inclusion and exclusion Trade Finance and Bank Charges, Overdraft interest shall form part of finance cost or bank interest, LC Commission shall form part of Raw Material cost or shall be treated as bank charges may not be relevant to IFRS just the accounting treatment 3.

Dear Silvia, I have seen one IFRS interoperatation Committe for Revenue Recognition when the Sales Contact is in Foreign Currency Foreign currency translation of Revenue Foreign currency translation of revenue: Contract signed Advance Payment Received Goods Supplied. Hi, More on this topic http: Dear Silvia, thank you in advance for that Article.

Hi Silvia, I am from the Philippines. Is there any possibility of an unrealized gain portion for cash? Also Silvia, I am not yet due to pay back the loanis the exchange rate realized or unrealized. Hi Silvia, I have one question as follow. Thank you in advance for your help, Andy N. Sorry, I would like to add further information. Thank you, Andy N. In paragraph 15 of IAS 21, it is stated as follows: Hope to see your answer, thanks! Dear Silvia, My company is located in Nigeria and functional currency is Naira.

My question Should I convert with closing rate assets or I should use historical rate. Dear Silvia, one question regarding PPE traslation. Dear Silvia, Kindly help me in regard to below query: Dear Sylvia, I work for an NPO and would like to know the treatment of exchange rate differences of funds received from donors. Hi, Please advise in case of devaluation of currency i.

Hello, Find your article and comments to be very useful. Hi Sivlia, We are an Online Travel Agent and acting like an agent according to; http: How to deal with the received prepayments and payments made to the final operators? EUR ,- No FX result should be shown in the report, based on IFRIC Post a Reply Name: How to Account for Debt Factoring or Selling of Receivables When I was auditing the financial statements of How to Make Consolidated Statement of Cash Flows with Foreign Currencies Did you know that many groups prepare their cons How to Make Hedging Documentation If your company enters into some derivatives or Troubles with IFRS 16 Leases The new lease standard IFRS 16 can initially cau This website uses cookies to improve your experience.

By continuing to browse this site you are agreeing to our use of cookies. Please enter your e-mail address. You will receive a new password via e-mail. Please check your inbox to confirm your subscription.