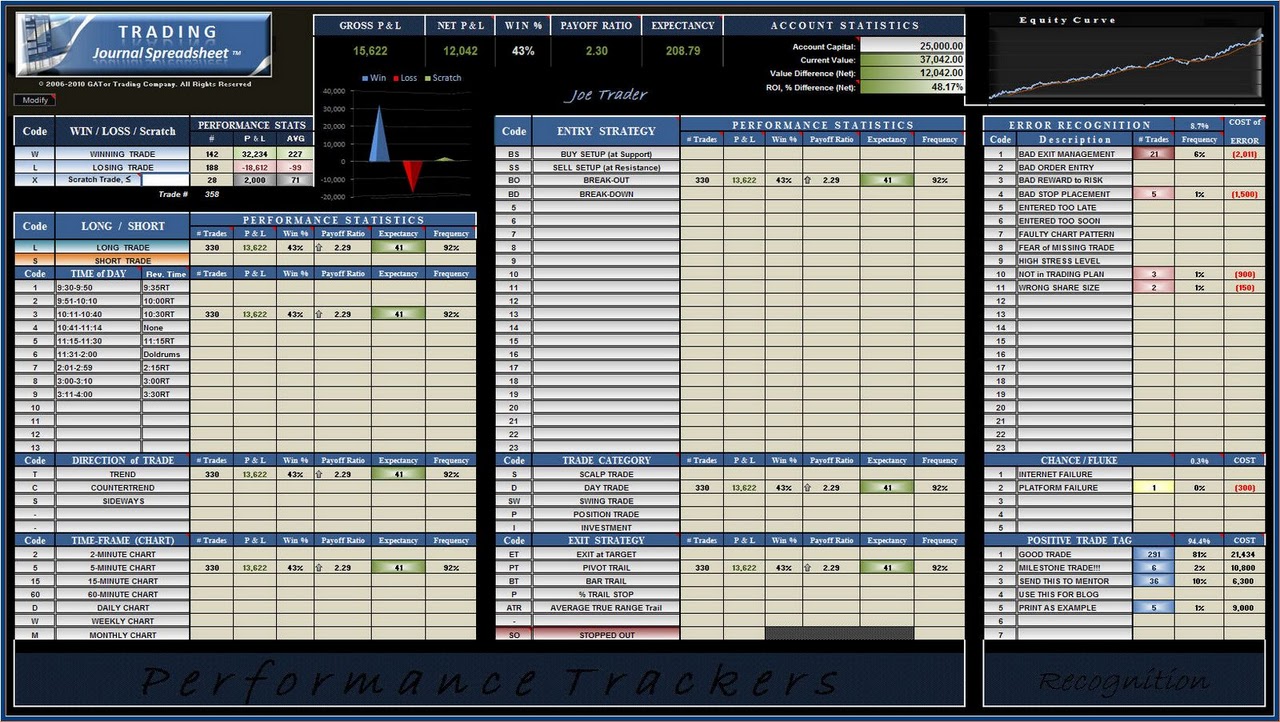

Trading journal spreadsheets for futures

Trade Log – Excel Spreadsheet | Anthony Marsland Trading Journal

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world. The methodology is in this white paper. In addition to being an index that is much quoted in articles about market complacency, the VIX is used as a reference price for derivatives: If you want to bet that stock-market volatility will go up, or down, you can buy or sell futures or options on the VIX.

These products are cash settled: The VIX is not a thing you can own, so if your option ends up in the money you just get paid cash for the value of the VIX at settlement. The auction runs from 7: We investigate alternative explanations of hedging and coordinated liquidity trading. Tests including those utilizing differences in put and call options, open interest around the settlement, and a similar volatility contract with an entirely different settlement procedure in Europe are inconsistent with these explanations but consistent with market manipulation.

So for instance in months where the trading pushes the VIX up, the prevailing price of the VIX-influencing options will jump during the auction, peak at around 8: The blue line there is a measure of the indicative prices of VIX-influencing options, spiking at 8: If you ignore the numbers on the axis, you can almost think of it as being a chart of the VIX price.

The red dot is the trading price of those options about 25 seconds after the auction finishes. The average effect is something like 0. What is going on? They argue that it's more likely to be explained by attempts to move the VIX: That is generically true in any derivatives market: If you are long a derivative, you can buy the underlying and push up the derivative price. First, the upper-level VIX market is large and liquid, enabling a trader to invest a sizeable position in VIX derivatives.

In contrast, many of the lower-level SPX options, where the VIX values are derived from, are illiquid. Griffin and Shams calculate that "the size of VIX futures with open interest at settlement is on average 5. You can move the price of those options a lot with relatively small trades, and those price changes have a disproportionate effect on the VIX.

cozosen.web.fc2.com

Second, the VIX derivatives are cash settled. Therefore, if the VIX settlement value deviates from its true value, the VIX position will automatically be cashed out at the deviated price. You get cash, so if the VIX is at the wrong price at settlement, that's the price you get. Third, the settlement occurs within a short period of time based on the SPX options pre-open auction. You don't have to intervene over some long period to keep options prices up; you can just submit bids in the pre-opening auction once a month and move the settlement price for that month.

There is a sort of hierarchy of manipulability in markets. At the top is Libor manipulation: Trillions of dollars of derivatives settled based on Libor, but Libor was calculated by essentially asking banks "what should Libor be? Later, with the fines, it was costly. There are cases of it!

But to make any money you then have to sell the stock, which should push the price right back down. You can move a lot of value in VIX products by trading a small amount of value, in a confined period of time, in the underlying market. If Griffin and Shams are right that there's manipulation, there's no particular pattern to it: Sometimes VIX gets anomalously pushed up during the settlement, sometimes down. It just makes someone money.

Carney was a bit tougher on his pretend-chairman than Staley was:. Not appropriate at all. Eventually the hoaxer will email a sexist joke to quantum binary options auto trader bank CEO who'll reply "hahahaha good one, also I killed a man last night," but so far the bankers are 2 for 2 on probity and tact.

Citigroup is a top sponsor of Consensus. Like the other big players interested in blockchain, Johnson acknowledged problems with current efforts. Committees were set up to study the problem; solutions were tried and rejected; nothing worked.

The employees were starving. It was a money off jones the bootmakers fit!

cozosen.web.fc2.com Stock Charting Software Review Report | MarketHEIST

Fidelity employees all have a lot of bitcoins, and bitcoins are an incredibly convenient way to pay for a sandwich. Elsewhere, Allison Schrager asks: Professional oil traders pay for professional data services that provide them with professional data.

Amateur oil traders get free data services that provide them with Google spreadsheets. You might quite reasonably say, look, there is no way for these hobbyists to compete with professional traders forex signal 4 u job is to trade oil and who have access to the best data.

And yet they keep trying. It's important to realize that not all trading in financial markets is driven by economic considerations. Sometimes people trade because it is fun. Trading journal spreadsheets for futures in privileged access to energy information, Carl Icahn's CVR Energy Inc.

Here is a Harvard Crimson article about about non-degree-granting executive education courses at the Harvard Business School, browning x bolt 270 synthetic stock includes this lovely bit of intra-Harvard snark about Tyra Banks:.

But there is this:. Participants in the program attend one three-week session per year for three years. Elsewhere in graduate business education, here's " Why Stanford MBAs Earn the Most ":. At Stanford, which Bloomberg Businessweek ranks as the second best MBA program in the U. I am skeptical that "pursue your passion" is a good generally applicable way to make a lot of money, but perhaps it works for MBA students. Maybe their passion is money! The article is also about what Manjoo calls "the fat start-up":.

Modern capital markets have since unlocked far grander opportunities for tech entrepreneurs. They are blessed with essentially unlimited access to money, and ideas that once seemed too expensive, too risky or just too crazy are now getting off the ground. These start-ups are fat — with capital, with industry-altering ambition and, to their critics, often more hedged forex day trading system pdf a little hubris.

Private markets are, as I like to say, the new public markets, and it's no sweat now to raise a few hundred million dollars without going public. It buys houses, and then tries to resell them at a profit. There is technology involved, sure: Trading journal spreadsheets for futures analyzes home-price data on computers rather than sending appraisers out to decide how much homes are worth; "houses it sells are fitted with internet-enabled cameras, sensors and door locks"; there's a website and an app.

But the business model is not "we build software and sell it," or "we build websites and sell ads against them.

Futures Trading with Excel SpreadsheetsBut the imperial ambitions of Silicon Valley mean that it's also a tech startup because, you know, everything is a tech startup, and tech startups are where the money is. You can raise money from technology venture capitalists to sell bags of wet vegetablesor houses: Everything in the world is technology, so tech investors can invest in anything. Elsewhere in unicorns, the Wall Street Journal visited the Park Slope unicorn store:. The family guided us through the unicorn transformation process.

The original size is better for everyday activities like a spin class, Mr. The New York Fed's Liberty Street Economics blog is keeping this worry alive with " Dealer Balance Sheets and Corporate Bond Liquidity Provision. That is a fraction of the levels before Greece ran aground in a decadelong economic crisis. All of the debt traded this year is about as much as was traded in half an hour, on average, from to The 21st-century American literary genre with the greatest chance of achieving immortality is Stuff That Food Marketers Say To Reporters.

Same share of stomach. China Hit by First Moody's Downgrade Since on Debt Risk. Trump's Path to a Balanced Budget Paved With Accounting Gimmicks. Glencore Makes Informal Takeover Approach to Bunge. Sues Fiat Chrysler Over Diesel Emissions. Vanguard's Bogle tells CFA Institute confab indexing-firm concentration concerns him. Sears Pushes Back Debt Payments.

Blackstone is Taking Over Mom-and-Pop Real-Estate Investing. Where Humans Still Rule Over Machines. After Complaints, Fannie Mae Will Stop Selling Homes to Vision Property. Fintech reinvents lottery bonds. Madoff Fund Paid Millions to Breeden Firm, Zero to Victims. Americans Are Taking More Paid Vacation Days.

People are worried about the water fountains at the U. Attorney's Office for the Southern District of New York. This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners. To contact the author of this story: Matt Levine at mlevine51 bloomberg.

To contact the editor responsible for this story: James Greiff at jgreiff bloomberg. Bloomberg Anywhere Remote Login Software Updates Manage Contracts and Orders. Facebook Twitter LinkedIn Instagram. About The Company Bloomberg London. Global Startups Bloomberg Technology TV Gadgets With Gurman Digital Defense Studio 1.

Latest Issue Debrief Podcast Subscribe. Climate Changed Video Series: Ventures Graphics Billionaires Game Plan Small Business Personal Finance Inspire GO The David Rubenstein Show Sponsored Content.

Also oil data, executive business education, fat unicorns and bond market liquidity. A daily take on Wall Street, finance, companies and stuff. Before it's here, it's on the Bloomberg Terminal. Matt Levine is a Bloomberg View columnist.

Court of Appeals for the Third Circuit. Trump, Russia and a Shadowy Business Partnership by Timothy L. Shakespeare Has Another Role for Trump.

WatersTechnology - global financial technology news and analysis

Trump Allows Dreamers to Stay. Climbing Down Into Airline Hell, Year by Year by Joe Nocera. Apple Gets Greedy in China by Adam Minter. Amazon's Real Target Isn't Whole Foods. It's Everything You Buy. The Wrong Kind of Entrepreneurs Flourish in America by Noah Smith.

Careers Made in NYC Advertise Ad Choices Website Feedback Help.