Incentive stock option disqualified disposition

Tax planning and compliance for investors Free Newsletter. An explanation of selling ISO stock before the end of the special holding period. When you exercise a nonqualified option you have to report and pay tax on compensation income.

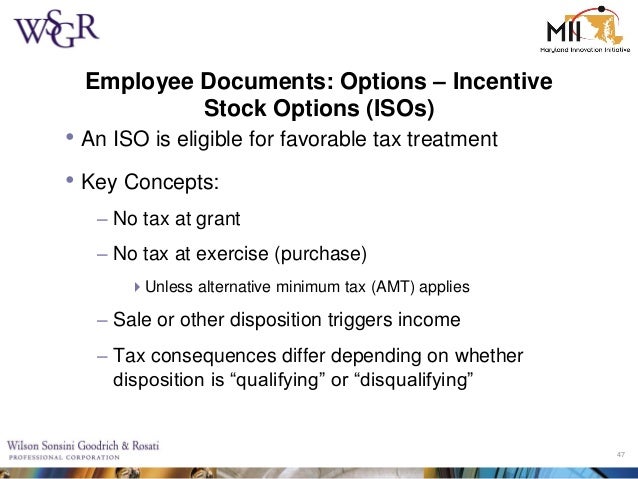

Stock Option TaxationYou don't report compensation income when you exercise an incentive stock option — and if you hold the stock long enough, you'll never report compensation income from that stock. Of course, you'll have to report a capital gain if you sell the stock for a profit. If you don't hold the stock long enough, you've made a disqualifying disposition.

You'll have to report some or all of your gain as compensation income, which usually means paying a much higher rate of tax.

What is a disqualifying disposition with incentive stock options, what can cause it, and why does my company care? - cozosen.web.fc2.com

To avoid a disqualifying disposition you have to hold the stock you acquired by exercising your ISO beyond the later of the following two dates:. Many employers don't permit exercise of an ISO within the first year after the employee receives it. If that's the case you don't have to worry about the holding more than two years after the date your employer granted the option.

If you hold the stock long enough to satisfy this special holding period, then any gain or loss you have on a sale of the stock will be long-term capital gain or loss.

Qualifying Disposition

You won't be required to report any compensation income from the exercise of your option. If you fail to satisfy the holding period described above, your sale or other disposition of the stock is considered a disqualifying disposition. In this case you'll have to report compensation income as described below. Everyone understands that a sale of the stock within the special holding period results in a disqualifying disposition. It's important to recognize that many other types of transfers can also result in a disqualifying disposition, for example:.

A transfer to a spouse or to a former spouse in connection with a divorce is a special case.

This is not considered a disqualifying disposition. Following such a transfer, the transferee spouse is subject to the same tax treatment as would have applied to the transferor. The transferor spouse should provide records needed to determine when the special holding period will be satisfied, the cost basis of the shares and the value of the shares at the time the option was exercised.

The tax consequences of a disqualifying disposition apply in the year the disposition occurs. You aren't supposed to go back and amend the return for the year you exercised the option, if that was an earlier year.

Incentive Stock Options - TurboTax Tax Tips & Videos

If your disqualifying disposition is a sale of your shares to an unrelated person without a "replacement purchase" see below , your tax consequences are as follows:. If you had a disqualifying disposition from a transaction other than a sale to an unrelated person such as a gift to someone other than your spouse, or a sale to a related person other than your spouse , or you bought replacement shares within 30 days before or after your sale, it's possible that the rules for that type of transfer don't permit the deduction of losses.

If your disqualifying disposition comes from a type of transaction where a deduction for losses is not permitted, the following rules apply:. A publication of Fairmark Press Inc. Thomas - WordPress Entries RSS and Comments RSS. Home Our Books News Tax Help Message Board About Contact. Fairmark Forum Reference Room Our books Free Newsletter RSS feed. About our website About our author Contact us Privacy.

Compensation in Stock and Options. Early Disposition of ISO Stock By Kaye A. Related Consider Your Options book for people who receive stock options Equity Compensation Strategies book for professional advisors Alternative Minimum Tax free online guide AMT and Equity Compensation forum for questions and comments on this topic Special Taxes easy access to forms for AMT or AMT credit.

Our books That Thing Rich People Do The fastest, easiest way to learn the principles of investing. Our complete guide to Roth IRAs and Roth accounts in k and similar plans: Consider Your Options A plain-language guide for people who receive stock options or other forms of equity compensation.

Equity Compensation Strategies A text for financial advisors and other professionals who offer advice on how to handle equity compensation including stock options. Capital Gains, Minimal Taxes Tax rules and strategies for people who buy, own and sell stocks, mutual funds and stock options. That Thing Rich People Do.

Incentive Stock Options - TurboTax Tax Tips & Videos

A plain-language guide for people who receive stock options or other forms of equity compensation. A text for financial advisors and other professionals who offer advice on how to handle equity compensation including stock options. Capital Gains, Minimal Taxes. Tax rules and strategies for people who buy, own and sell stocks, mutual funds and stock options.