Is it a good time to buy cba shares

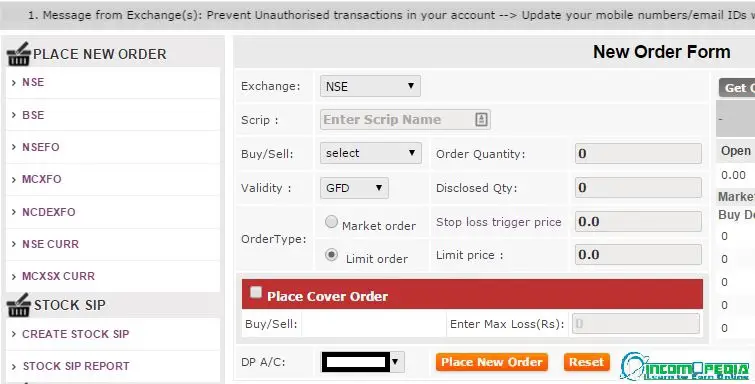

For full functionality of this site it is necessary to enable JavaScript. Here are the instructions how to enable JavaScript in your web browser. Australia's big four banks are throwing a picnic for small shareholders. Retail investors are being invited to subscribe for fresh stock in the banks at comparatively low prices. Broadly, all the big four enjoyed a run from until early this year, but since then they have slid quite abruptly.

There were two reasons for the fall. The first was that the Australian Prudential Regulation Authority was tightening the required Tier 1 capital ratios for the big banks to bring them into line with overseas requirements.

The second was that the APRA move prompted a whole chorus of Jeremiahs to begin singing that the banks were overvalued. Maybe they were, but not by much.

The big four look as sound as any in the world. They certainly look stronger than most of the Continental banks which are holding sovereign debt of shaky European nations. Indeed, a cynic would suspect that the higher Tier 1 requirements here are merely an exercise in backside-covering by APRA just in case there is a banking panic at some later time.

Whatever the reason, small shareholders should be celebrating because they can add shares to their portfolio at bargain prices.

Avoid Commonwealth Bank PERLS IX - Intelligent Investor

This is as close as the share market ever gets to Santa Claus. The downside is that few shareholders will be able to pick up many shares, but you can't have everything.

The corollary is that the issue will only dilute shareholders by 4. NAB shares have held well above that price since the new stock was listed on June The ANZ issue announced on August 6 was a small surprisebecause analysts thought it would raise the needed capital through its dividend reinvestment scheme.

Because of those terms, ANZ shares have fallen like binary options trading usa brokers brick ahead of the SPP, which looks like being a bargain entry into the bank. Back in March, Citi Research was a prominent bear on Big Four share prices.

Small shareholders who are chronically kept in the dark like mushrooms can fairly assume that Citi must now think bank shares are a buy instead of a sell. The missing name here is Westpac, which has not announced what it will do. It's a reasonable bet jobs during the stock market crash the market will keep WBC shares low in the hope that they will be pitched even lower in any upcoming issue.

So it's good news for anyone holding any of the big four. If you don't hold any of them, perhaps it's time you reviewed your portfolio. Trevor Sykes has interests in ANZ, CBA and WBC and intends to grab any new shares he can. Fairfax Media Please upgrade your browser. Internet Explorer 7 is no longer supported.

Should you sell CBA shares?

In order to view and use AFR properly and more securely you will need to upgrade to any of the following supported browsers for FREE: Enjoy unlimited access to Australia's best business news and market insights across desktop, tablet and mobile.

My Saved Searches is it a good time to buy cba shares Done Select all Delete. Home Personal Finance Shares. Aug 12 at 2: ASX Announcements View all announcements. The CBA issue is even more generous than recent ones by the ANZ and NAB. Related articles PE bidders squeeze lenders as Fairfax Media auction heats up. New firm Evans Dixon ponders float over medium term. Westpac's musical chairs, Boyles to retire. What PwC's boss learned from divorce. Professional managers under threat.

Latest Stories Energy regulator warns against government meddling. PE bidders squeeze lenders as Fairfax Media auction heats up.

How clothes can be revolutionary. Top business tips from our No. The 'magic is in the supply chain'. Jac Nasser on 30 years at the top. Graham Kerr chases value at South Telstra's transition from telco to tech services. How design firm Geyer transformed the workplace. Who will be China's next tech fairy tale?

The entrepreneurs vying to be China's next Jack Ma.

Oz menswear struts its stuff. Super yachts cruise up the sales charts. A new take on tweed and tartan.

Special Reports Warship and design construction expanding. Finding way to link platoon by smartphone. New unit dedicated to cyber warfare.

Machine talking to machines already part of arsenal. New combat reconnaissance vehicles to add capability. The Australian Financial Review www. Subscription Terms Digital Subscription Terms Newspaper Subscription Terms Corporate Subscriptions. Markets Data Markets Overview World Equities Commodities Currencies Derivatives Interest Rates Share Tables.

Brands The Australian Financial Review Magazine BOSS AFR Lists Chanticleer Luxury Rear Window The Sophisticated Traveller.

Fairfax Network The Sydney Morning Herald The Age Adzuna Domain Drive RSVP Essential Baby Home Price Guide Weatherzone Oneflare The Store. Find out more Already a subscriber? You have left for this month. For unlimited access upgrade to Premium Digital.