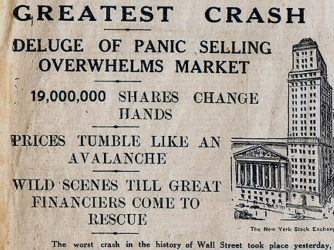

Newspaper article of the stock market crash 1929

As the economy grew, stock prices soared. By the end of the decade, as many as 25 million Americans had placed money in the stock market in order to share in the wealth.

The best part of the process was that you didn't need a lot of cash to join the party. You could buy your stock on margin. That is, borrow the money for your stock purchase using the value of the stock itself as collateral. It is estimated that by , the total amount of debt amassed by the practice had reached six billion dollars. It was a house of cards that remained erect as long as stocks continued to increase in value. However, if stock prices plummeted, the whole rickety structure could collapse.

Variety's headline after the Crash The tremors that would eventually destroy this flimsy economic edifice made their first rumblings in September The market dropped sharply at the beginning of the month but rose again only to drop and rise again. The rollercoaster ride continued in October as the beginning of the month saw another drop followed by another burst of strength.

Wall Street financers were able to reverse the downward plunge only by buying as many shares of stock as they could over the next two days. It was a temporary victory. Monday's opening bell unleashed a frenzy of selling that soon turned into an uncontrolled panic that continued for the rest of the trading day.

According to one observer, traders "hollered and screamed, they clawed at one another's collars. It was like a bunch of crazy men. Every once in a while, when Radio or Steel or Auburn would take another tumble, you'd see some poor devil collapse and fall to the floor.

The Market continued its decline but never as dramatic. Thirty billion dollars had been lost - more than twice the national debt.

The Stock Market Crash of 1929 - Causes and EffectsThe nation reeled, and slipped into the depths of the Great Depression. We join his story following "Black Thursday. The great buildings were ablaze with lights all night as sleepy clerks fought desperately to get the accounts in shape for the Monday opening.

Horrified brokers watched the selling orders accumulate.

It wasn't a flood; it was a deluge. Everybody wanted to sell-the man with five shares and the man with ten thousand. Evidently the week-end cheer barrage had not hit its mark. Leading stocks broke through the support levels as soon as trading started and kept sinking all day. Periodically the news would circulate that the banks were about to turn the tide as they had done on Thursday, but it didn't happen.

A certain cynicism developed in the board rooms as the day wore on. Obviously the big financial interests had abandoned the market to its fate, probably intending to pick up the fragments cheap when the wreck hit the final bottom.

When the market finally closed, 9,, shares had been sold. The Times index of 25 industrials fell from The whole list showed alarming losses, and margin calls were on their way to those speculators who had not already sold out.

That night Wall Street was lit up like a Christmas tree. Restaurants, barber shops, and speakeasies were open and doing a roaring business. Messenger boys and runners raced through the streets whooping and singing at the tops of their lungs. Slum children invaded the district to play with balls of ticker tape.

Well-dressed gentlemen fell asleep in lunch counters.

Newspaper Archives | NewspaperArchive®

All the downtown hotels, rooming houses, even flophouses were full of financial employees who usually slept in the Bronx. It was probably Wall Street's worst night. Not only had the day been bad, but everybody down to the youngest office boy had a pretty good idea of what was going to happen tomorrow. Bewildered crowds on Wall Street The morning papers were black with the story of the Monday smash.

Stock Market Crash of

Except for rather feeble hopes that the great banks would step into the gap they had no heart for cheerful headlines. In the inside pages, however, the sunshine chorus continued as merry as ever. Bankers said that heavy buying had been sighted on the horizon. Brokers were loud with "technical" reasons why the decline could not continue. It wasn't only the financial bigwigs who spoke up. Even the outriders of the New Era felt that if everybody pretended to be happy, their phoney smiles would blow the trouble away.

Jimmy Walker, for example, asked the movie houses to show only cheerful pictures. True Story Magazine , currently suffering from delusions of grandeur, ran full page advertisements in many papers urging all wage earners to buy luxuries on credit.

That would fix things right up. McGraw-Hill Company, another publishing house with boom-time megalomania, told the public to avert its eyes from the obscene spectacle in Wall Street. What they did not observe would not affect their state of mind and good times could continue as before. These noble but childish dabbles in mass psychology failed as utterly as might have been expected. Even the more substantial contributions of U.

Ordinarily such action would have sent the respective stocks shooting upward, but in the present mood of the public it created not the slightest ripple of interest.

Steel and Can plunged down as steeply as if they had canceled their dividends entirely. The next day, Tuesday, the 29th of October, was the worst of all. In the first half hour 3,, shares were traded, almost a full day's work for the laboring machinery of the Exchange.

The selling pressure was wholly without precedent. It was coming from everywhere. The wires to other cities were jammed with frantic orders to sell. So were the cables, radio and telephones to Europe and the rest of the world.

The Wall Street Crash,

Buyers were few, sometimes wholly absent. Often the specialists stood baffled at their posts, sellers pressing around them and not a single buyer at any price. This was real panic. It was what the banks had prevented on Thursday, had slowed on Monday. Now they were helpless. Reportedly they were trying to force their associated corporations to toss their buying power into the whirlpool, but they were getting no results. Albert Conway, New York State Superintendent of Insurance, took the dubious step of urging the companies under his jurisdiction to buy common stocks.

If they did so, their buying was insufficient to halt the rout. A Prisoner of the Boxer Rebellion, The Galveston Hurricane of Farm Wife, The Death of Queen Victoria, The Assassination of President William McKinley, The Roosevelts Move Into the White House, Riding a Rural Free Delivery Route, First Flight, The Gibson Girl Early Adventures With The Automobile Immigrating to America, The San Francisco Earthquake, Henry Ford Changes the World, A Walk with President Roosevelt, Children At Work, On Safari, Birth of the Hollywood Cowboy, Doomed Expedition to the South Pole, Sinking of the Titanic, 1st Woman to Fly the English Channel, The Bolsheviks Storm the Winter Palace, The Execution of Tsar Nicholas II, President Wilson Suffers a Stroke, Making Movies, Entering King Tut's Tomb, Coolidge Becomes President, Adolf Hitler Attempts a Coup, Air Conditioning Goes to the Movies, Prohibition, Lindbergh Flies the Atlantic, Babe Ruth Hits His 60th Home Run, The Wall Street Crash, The Bonus Army Invades Washington, D.

Kennedy, First Voyage to the Moon, President Nixon Meets Elvis, Payoff to the Vice President, President Nixon Leaves the White House World War One World War Two Photo of the Week SnapShots Voices Index Home.