European union emissions trading system (eu ets)

The European Union Emissions Trading System EU ETS , also known as the European Union Emissions Trading Scheme , was the first large greenhouse gas emissions trading scheme in the world, and remains the biggest. Under the 'cap and trade' principle, a maximum cap is set on the total amount of greenhouse gases that can be emitted by all participating installations.

Installations must monitor and report their CO 2 emissions, ensuring they hand in enough allowances to the authorities to cover their emissions. If emission exceeds what is permitted by its allowances, an installation must purchase allowances from others.

Conversely, if an installation has performed well at reducing its emissions, it can sell its leftover credits. This allows the system to find the most cost-effective ways of reducing emissions without significant government intervention. The scheme has been divided into a number of "trading periods".

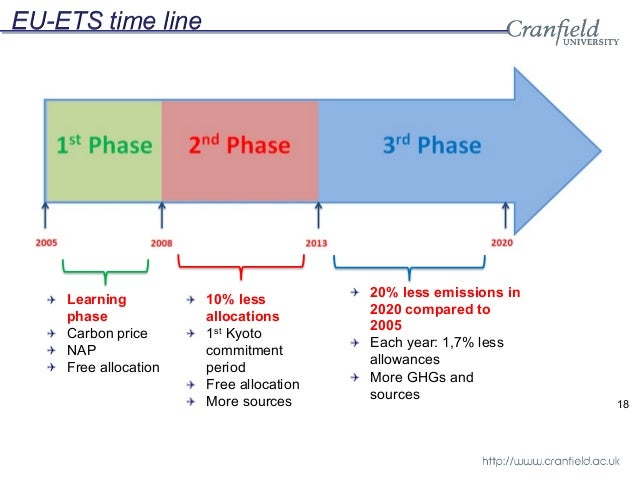

The first ETS trading period lasted three years, from January to December The second trading period ran from January until December , coinciding with the first commitment period of the Kyoto Protocol.

The third trading period began in January and will span until December This target has been reached 6 years early as emissions in the ETS fell to mln tonnes in The EU ETS has seen a number of significant changes, with the first trading period described as a 'learning by doing' phase.

Overall, since its conception, the EU ETS has been characterized by relatively high levels of policy uncertainty. As a result, the scheme has resulted in a rather informal and tepid response by regulated organizations. The first phase of EU ETS was created to operate apart from international climate change treaties such as the pre-existing United Nations Framework Convention on Climate Change UNFCCC, or the Kyoto Protocol that was subsequently established under it.

When the Kyoto Protocol came into force on 16 February , Phase I of the EU ETS had already become operational. The EU later agreed to incorporate Kyoto flexible mechanism certificates as compliance tools within the EU ETS. The "Linking Directive" allows operators to use a certain amount of Kyoto certificates from flexible mechanism projects in order to cover their emissions.

IET is relevant as the reductions achieved through CDM projects are a compliance tool for EU ETS operators. These Certified Emission Reductions CERs can be obtained by implementing emission reduction projects in developing countries, outside the EU, that have ratified or acceded to the Kyoto Protocol. The implementation of Clean Development Projects is largely specified by the Marrakech Accords , a follow-on set of agreements by the Conference of the Parties to the Kyoto Protocol.

The legislators of the EU ETS drew up the scheme independently but called on the experiences gained during the running of the voluntary UK Emissions Trading Scheme in the previous years, [14] and collaborated with other parties to ensure its units and mechanisms were compatible with the design agreed through the UNFCCC. Under the EU ETS, the governments of the EU Member States agree on national emission caps which have to be approved by the EU commission. Those countries then allocate allowances to their industrial operators, and track and validate the actual emissions in accordance with the relevant assigned amount.

They require the allowances to be retired after the end of each year. Like any other financial instrument , trading consists of matching buyers and sellers between members of the exchange and then settling by depositing a valid allowance in exchange for the agreed financial consideration.

Much like a stock market , companies and private individuals can trade through brokers who are listed on the exchange, and need not be regulated operators. When each change of ownership of an allowance is proposed, the national registry and the European Commission are informed in order for them to validate the transaction.

During Phase II of the EU ETS, the UNFCCC also validates the allowance and any change that alters the distribution within each national allocation plan. Like the Kyoto trading scheme, EU ETS allows a regulated operator to use carbon credits in the form of Emission Reduction Units ERU to comply with its obligations.

A Kyoto Certified Emission Reduction unit CER , produced by a carbon project that has been certified by the UNFCCC's Clean Development Mechanism Executive Board, or Emission Reduction Unit ERU certified by the Joint Implementation project's host country or by the Joint Implementation Supervisory Committee, are accepted by the EU as equivalent.

Thus one EU Allowance Unit of one tonne of CO 2 , or "EUA", was designed to be identical " fungible " with the equivalent " Assigned Amount Unit " AAU of CO 2 defined under Kyoto.

Hence, because of the EU's decision to accept Kyoto-CERs as equivalent to EU-EUA's, it is possible to trade EUA's and UNFCCC-validated CERs on a one-to-one basis within the same system. However, the EU was not able to link trades from all its countries until because of its technical problems connecting to the UN systems. During Phase II of the EU ETS, the operators within each Member State must surrender their allowances for inspection by the EU before they can be "retired" by the UNFCCC.

The total number of permits issued either auctioned or allocated determines the supply for the allowances. The actual price is determined by the market. Too many allowances compared to demand will result in a low carbon price, and reduced emission abatement efforts. For each EU ETS Phase, the total quantity to be allocated by each Member State is defined in the National Allocation Plan equivalent to its UNFCCC-defined carbon account.

The EU Emissions Trading System (EU ETS) | Climate Action

The first and foremost criterion is that the proposed total quantity is in line with a Member State's Kyoto target. Of course, the Member State's plan can, and should, also take account of emission levels in other sectors not covered by the EU ETS, and address these within its own domestic policies.

This approach has been criticized [19] as giving rise to windfall profits , being less efficient than auctioning, and providing too little incentive for innovative new competition to provide clean, renewable energy. To address these problems, [ citation needed ] the European Commission proposed various changes in a January package, including the abolishment of NAPs from and auctioning a far greater share ca.

From the start of Phase III January there will be a centralised allocation of permits, not National Allocation Plans, with a greater share of auctioning of permits. Allocation can act as a means of addressing concerns over loss of competitiveness , and possible "leakage" carbon leakage of emissions outside the EU.

Leakage is the effect of emissions increasing in countries or sectors that have weaker regulation of emissions than the regulation in another country or sector. Correcting for leakage by allocating permits acts as a temporary subsidy for affected industries, but does not fix the underlying problem.

Border adjustments would be the economically efficient choice, where imports are taxed according to their carbon content. Within a certain trading period, banking and borrowing is allowed. For example, a EUA can be used in Banking or in Borrowing. Interperiod borrowing is not allowed.

Member states had the discretion to decide if banking EUA's from Phase I to Phase II was allowed or not. However, the prior existence of the UK Emissions Trading Scheme meant that market participants were already in place and ready.

In , carbon prices for the trial phase dropped to near zero for most of the year. Meanwhile, prices for Phase II remained significantly higher throughout, reflecting the fact that allowances for the trial phase were set to expire by 31 December Verified emissions show a net increase over the first phase of the scheme. For the countries for which data was available, emissions increased by 1.

Consequently, observers have accused national governments of abusing the system under industry pressure, and have urged for far stricter caps in the second phase — The second phase —12 expanded the scope of the scheme significantly.

In , three non-EU members, Norway, Iceland , and Liechtenstein joined the scheme. Although this was a theoretical possibility in phase I, the over-allocation of permits combined with the inability to bank them for use in the second phase meant it was not taken up.

On 27 April , the European Commission announced the full activation of the EU Emissions Trading System single registry. The full activation process will include the migration of over 30, EU ETS accounts from national registries.

The EC has further stated that the single registry to be activated in June will not contain all the required functionalities for phase III of the EU ETS. Aviation emissions were to be included from According to DEFRA, an increased use of JI credits from projects in Russia and Ukraine , would offset any increase in prices so there would be no discernible impact on average annual CO 2 prices.

The airline industry and other countries including China, India, Russia, and the United States reacted adversely to the inclusion of the aviation sector. On 27 November the United States enacted the European Union Emissions Trading Scheme Prohibition Act of which prohibits U.

In the absence of a global agreement on airline emissions, the EU argued that it was forced to go ahead with its own scheme which included an exemption clause for countries with "equivalent measures".

Ultimately, the Commission intended that the third trading period should cover all greenhouse gases and all sectors, including aviation, maritime transport, and forestry. In late , European Commission started infringement proceedings against Austria, Czech Republic, Denmark, Hungary, Italy and Spain, for failure to submit their proposed National Allocation Plans on time.

The annual Member State CO 2 yearly allowances in million tonnes are shown in the table:. Additional installations and emissions included in the second trading period are not included in this table but are given in the sources. Prices for EU allowances for December delivery dropped 8. In March , according to the periodical Economist , the EUA permit price under the EU ETS had "tanked" and was too low to provide incentives for firms to reduce emissions.

The market had been oversupplied with permits. In July , Thomson Reuters Point Carbon stated that it considered that without intervention to reduce the supply of allowances, the price of allowances would fall to four Euros.

For Phase III — , the European Commission has proposed a number of changes, including CCC, , p.

What is the emissions trading scheme and does it work? | Environment | The Guardian

As well as more sectors and gases included in Phase III. Also, millions of allowances set aside in the New Entrants Reserve NER to fund the deployment of innovative renewable energy technologies and carbon capture and storage through the NER programme,one of the world's largest funding programmes for innovative low-carbon energy demonstration projects.

Ahead of its accession to the EU, Croatia joined the ETS at the start of Phase III on 1 January On 4 January , European Union allowances for traded on London's ICE Futures Europe exchange for between 6. Phase IV will commence on 1 January and finish on 31 December The European Commission plans a full review of the Directive by Connie Hedegaard, the EU Commissioner for Climate Change, hoped "to link up the ETS with compatible systems around the world to form the backbone of a global carbon market" with Australia cited as an example.

Before the European Council summit on 20 March , [69] the European Commission decided to propose a change in the functioning of the carbon market CO2 permits. The submitted legislation on the Market Stability Reserve system MSR would change the amount of annually auctioned CO2 permits based on the amount of CO2 permits in circulation. The reserve would operate on predefined rules with no discretion for the Commission or Member States.

The European Parliament and the European council informally agreed on an adapted version of this proposal, which sets the starting date of the MSR to so already in Phase III , puts the million backloaded allowances in the reserve and reduces the reaction time of the MSR to one year. This adapted proposal has already passed the European parliament and is to be approved by the Council of ministers in September Emissions in the EU have been reduced at costs that are significantly lower than projected, [26] though transaction costs are related to economies of scale and can be significant for smaller installations.

It was suggested that if permits were auctioned, and the revenues used effectively, e. Currently, the EU does not allow CO 2 credits under ETS to be obtained from sinks e. However, some governments and industry representatives lobby for their inclusion. The inclusion is currently opposed by NGOs as well as the EU commission itself, arguing that sinks are surrounded by too many scientific uncertainties over their permanence and that they have inferior long-term contribution to climate change compared to reducing emissions from industrial sources.

A phishing scam is suspected to have enabled hackers to log into unsuspecting companies' carbon credit accounts and transfer the allowances to themselves, allowing them to then be sold.

The European Commission said it would "proceed to determine together with national authorities what minimum security measures need to be put in place before the suspension of a registry can be lifted".

Maria Kokkonen, EC spokeswoman for climate issues, said that national registries can be reopened once sufficient security measures have been enacted and member countries submit to the EC a report of their IT security protocol. The Czech registry said there are still legal and administrative hurdles to be overcome and Jiri Stastny, chairman of OTE AS, the Czech registry operator, said that until there is recourse for victims of such theft, and a system is in place to return allowances to their rightful owners, the Czech registry will remain closed.

Registry officials in Germany and Estonia have confirmed they have located , allowances stolen from the Czech registry, according to Mr. Another , of the stolen Czech allowances are thought to be in accounts in the UK, according to the OTE.

The security breaches raised fears among some traders that they might have unknowingly purchased stolen allowances which they might later have to forfeit.

In December a German court sentenced six people to jail terms of between three years and seven years and 10 months in a trial involving evasion of taxes on carbon permits. A French court sentenced five people to one to five years in jail, and to pay massive fines for evading tax through carbon trading. In the UK a first trial over VAT fraud in the carbon market is put on track to start in February Different people and organizations have responded differently to the EU ETS.

Mr Anne Theo Seinen, of the EC's Directorate-General for the Environment, described Phase I as a "learning phase", where, for example, the infrastructure and institutions for the ETS were set up UK Parliament, Seinen also commented that the EU ETS needed to be supported by other policies for technology and renewable energy. According to CCC , p.

In the World Wildlife Fund commented that there was no indication that the EU ETS had influenced longer-term investment decisions. The EU ETS has been criticized [87] for several failings, including: In addition, the EU ETS has been criticized as having caused a disruptive spike in energy prices. Researchers Preston Teeter and Jorgen Sandberg have argued that it is largely the uncertainty behind the EU's scheme that has resulted in such a tepid and informal response by regulated organizations.

Their research has revealed a similar outcome in Australia, where organizations saw little incentive to innovate and even comply with cap and trade regulations. There was an oversupply of emissions allowances for EU ETS Phase I. This drove the carbon price down to zero in CCC, , p. This problem naturally diminishes as the cap tightens. Over-allocation does not imply that no abatement occurred. Even with over-allocation, there was theoretically a price on carbon except for installations that received hundreds of thousands of free allowances.

For some installations, the price had a some effect on emitters' behavior. In September Thomson Reuters Point Carbon calculated that the first Kyoto Protocol commitment period had been oversupplied by about 13 billion tonnes According to Newbery , the price of EUAs was included in the final price of electricity.

Newbery wrote that "[there] is no case for repeating such a wilful misuse of the value of a common property resource that should be owned by the country".

In the view of 4CMR , all permits in the EU ETS should be auctioned. The price of emissions permits tripled in the first six months of Phase I, collapsed by half in a one-week period in , and declined to zero over the next twelve months. Such movements and the implied volatility raise questions about the viability of this trading system to provide stable incentives to emitters.

This criticism has face validity. In future phases, measures such as banking of allowances and price floors may be used to mitigate volatility. Nonetheless, producers and consumers in those markets respond rationally and effectively to price signals.

Newbery commented that the EU ETS was not delivering the stable carbon price necessary for long-term, low-carbon investment decisions.

The EU ETS is 'linked' to the Joint Implementation and Clean Development Mechanism projects as it allows the limited use of 'offset credits' from them. Participating firms were allowed to use some Certified Emission Reduction units CERs from and Emission Reduction Units ERUs from Each Member State's National Allocation Plan must specify a percentage of the national allocation that will be the cap on the CERs and ERUs that may be used.

CERs and ERUs from nuclear facilities and from land use, land use change and forestry may not be used. The main theoretical advantage of allowing free trading of credits is that it allows mitigation to be done at least-cost CCC, , p. In terms of the UK's climate change policy, CCC , noted three arguments against too great a reliance on credits:.

In January , the EU Climate Change Committee banned the use of CDM Certified Emission Reduction units from HFC destruction in the European Union Emissions Trading Scheme from 1 May The ban includes nitrous oxide N2O from adipic acid production.

The reasons given were the perverse incentives, the lack of additionality, the lack of environmental integrity,the under-mining of the Montreal Protocol, costs and ineffectiveness and the distorting effect of a few projects in advanced developing countries getting too many CERs. As an alternative to CDM and JI projects, emissions can be offset directly by buying and deleting emissions allowances inside the ETS.

This is a way to avoid several problems of CDM and JI such as additionality, measurement, leakage, permanence, and verification. Furthermore, it reduces the available allowances in the cap-and-trade system, which means that it reduces the emissions that can be produced by covered sources. The EU is negotiating a link with Switzerland's domestic trading system. Linking [] systems creates a larger carbon market, which can reduce overall compliance costs, increase market liquidity and generate a more stable carbon market.

Some scholars have argued that linking may provide a starting point for developing a new, bottom-up international climate policy architecture whereby multiple unique systems successively link their various systems. From Wikipedia, the free encyclopedia. Origins, Allocation, and Early Results".

Review of Environmental Economics and Policy. Retrieved 5 June Corporate Energy Management Strategies to Address Climate Change and GHG Emissions in the European Union.

Centre for Sustainability Management, , p. How Policy Uncertainty Affects Organizational Responses to Flexible Environmental Regulations". British Journal of Management. Memorandum submitted by David Newbery, Research Director, Electric Policy Research Group University of Cambridge.

The role of carbon markets in preventing dangerous climate change. The fourth report of the —10 session. UK Parliament House of Commons Environmental Audit Select Committee. Retrieved 30 April Oxford Review of Economic Policy. Retrieved 30 August Retrieved 6 June ILEX Energy Consulting Ltd. Climate Action Network Europe. Memorandum submitted by Karsten Neuhoff, Assistant Director, Electric Policy Research Group, University of Cambridge.

Retrieved 1 May Minutes of Evidence, Tuesday 21 April Produced by the UK Parliament House of Commons Environmental Audit Select Committee.

The fourth report of the —10 session". Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change , Print version: Cambridge University Press, Cambridge, U. Ten Insights from Europe on the EU Emissions Trading System". Retrieved 28 June Lessons to be learned".

Massachusetts Institute of Technology Energy Initiative. Retrieved 25 October Europe's carbon trading scheme". A Preliminary Analysis of the EU ETS Based on the Emissions Data" PDF. Environmental and Resource Economics. Unethical, Unjust and Ineffective? Royal Institute of Philosophy Supplement.

European Union Emission Trading Scheme - Wikipedia

Retrieved 26 April European Commission Press Release. Retrieved 25 March Retrieved 28 October Linking in the EU ETS Bulletin. International Institute for Sustainable Development IISD. Retrieved 10 August The National Law Review. Retrieved 4 June Retrieved 10 February Impact on EU allowance prices" PDF. ICF Consulting for DEFRA.

Archived from the original PDF on 15 February Retrieved 27 January An Act To prohibit operators of civil aircraft of the United States from participating in the European Union's emissions trading scheme, and for other purposes. The New York Times. The Swedish Environmental Protection Agency. Commission decides on first set of national allocation plans for the — trading period". Carbon markets and carbon prices". The First Report of the Committee on Climate Change. EU Europa Environment Committee.

EU-wide cap for — set at 2. Retrieved 24 January Meeting Carbon Budgets — the need for a step change PDF. Progress report to Parliament Committee on Climate Change. Presented to Parliament pursuant to section 36 1 of the Climate Change Act The Stationery Office TSO. Retrieved 3 April Retrieved 6 January Retrieved 14 January The European Union's flagship climate policy, its emissions trading scheme ETS , saw the price of carbon crash to a record low on Thursday after a vote in Brussels against a proposal to support the struggling market.

Retrieved 18 February Transaction Costs and Tradable Permits: Empirical Evidence from the EU Emissions Trading Scheme. Retrieved 8 August The Wall Street Journal. Retrieved 16 April Oral and Written Evidence, Tuesday, 12 May Oral and Written Evidence, Tuesday 31 March Recent Emission-Reduction Policy Initiatives. Climate Change and the Global Economy N.

World Economic and Financial Surveys: Housing and the Business Cycle". Retrieved 21 April Frankfurt am Main, Germany: KfW Bankengruppe and Centre for European Economic Research ZEW. Kyoto and Beyond U. Thomson Reuters Point Carbon. Retrieved 28 November Retrieved 16 February Commission welcomes vote to ban certain industrial gas credits".

Retrieved 18 September Opening negotiations with Switzerland on linking Emissions Trading Systems.

Incremental Alignment of Cap-and-Trade Markets. To link or not to link: Climate Policy, 9 4 , — Linkage of Greenhouse Gas Emissions Trading Systems - Learning from Experience.

Discussion Paper Resources For The Future, No.

The EU Emissions Trading System (EU ETS) | Climate Action

Linking emissions trading systems. Retrieved from " https: Carbon emissions in the European Union Carbon finance Climate change in the European Union Climate change policy Emissions trading Energy policies and initiatives of the European Union Energy treaties Renewable energy law. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page.

Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 10 April , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. This section's tone or style may not reflect the encyclopedic tone used on Wikipedia.

See Wikipedia's guide to writing better articles for suggestions. May Learn how and when to remove this template message. This article's Criticism or Controversy section may compromise the article's neutral point of view of the subject.

Edinburgh University Low Carbon Society - The Future of the EU Emissions Trading System (EU ETS)Please integrate the section's contents into the article as a whole, or rewrite the material.