Is retained earnings included in the cash flow statement

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website.

See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details. Published on Jul 27, Clipping is a handy way to collect and organize the most important slides from a presentation. You can keep your great finds in clipboards organized around topics. SlideShare Explore Search You. Show related SlideShares at end. Full Name Comment goes here. Are you sure you want to Yes No.

Embeds 0 No embeds.

No notes for slide. Statement of Cash Flows: The objective of the statement of cash flows is to provide the user of the financial statements with information as to how the reporting entity has generated cash during the reporting period and how the entity has spent that cash during the reporting period. It is important to know your cash flow so that you may adequately plan your expenditures. Should there be a cut back on payments because of a cash problem? Where are you getting most of your cash?

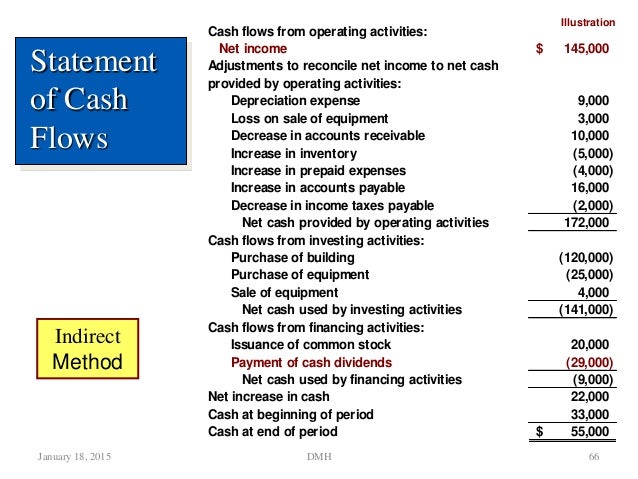

What products or projects are cash drains or cash cows? Is there enough money to pay bills and buy needed machinery? Purposes of the statement. To provide information about the cash receipts and cash payments of an entity during a period. Important information for financial statement users. To summarize the operating, investing, and financing activities of the business. Uses of the statement. Reconciling the difference between net income and net cash flow from operating activities.

Assessing the cash and noncash investing and financing transactions during the period 5. The statement of cash flow is segregated into the following three parts; Operating activities are the day-to-day revenue-producing activities. They are connected to the manufacture and sale of goods or the rendering of services. These include net income, depreciation and changes in current assets and current liabilities other than cash and short term debt.

Investing activities are the acquisition and disposal of long-term assets that are not considered to be cash equivalents. Acquisition of property, plant and equipment PPE. Investing in long term investments. Financing activities are those activities which change the capital and borrowing structure of the reporting entity. Examples of such financing activities are: Loans taken out in the year.

Proceeds from share issues. Buy back of equity shares. Cash inflow Revenue from sale of goods and services Interest from debt instruments of other entities Dividends from equities of other entities Cash outflow Payments to suppliers Payments to employees Payments to Government Payments to Lenders Payments for other expenses 7.

Cash inflow Sale of Property, Plant, and Equipment Sale of Debt or Equity Securities other entities Collection of principal on loans to other entities Cash outflow Purchase Property, Plant, and Equipment Purchase Debt or Equity Securities other entities Lending to other entities 8.

Cash inflow Sale of Equity Securities Issuance of Debt Securities Cash outflow Dividends to shareholders Redemption of long-term debt Redemption of capital stock 9. Information for the preparation of the Statement of Cash Flows is derived from three sources: Comparative Balance Sheets Current income statements Selected transaction data Three steps: Determine Change in Cash Determine net cash flow from operating activities Determine cash flow from investing and financing activities The retained earnings statement reconciles the beginning and ending balances in the retained earnings account.

This statement can be presented as a separate statement or in a combined statement of income and retained earnings.

A company's overall net income will cause retained earnings to increase and a net loss will result in a decrease. Retained earnings is also reduced by shareholder dividends.

Using the Indirect Method to Prepare the Statement of Cash Flows

The statement of retained earnings provides a succinct reporting of these changes in retained earnings from one period to the next. Prepare the Heading for the Statement of Retained Earnings A Statement of Retained Earnings should have a three-line header. The first line is the name of the company. The second line is simply, "Statement of Retained Earnings.

State the Balance of Retained Earnings from the Prior Year The first item on the Statement of Retained Earnings should be the balance of retained earnings from the prior year. This comes from the prior year's balance sheet.

The first line for the Statement of Retained Earnings would look like this: Add Net Income from the Income Statement The Statement of Retained Earnings should be the second financial statement prepared. The Income Statement is the first financial statement prepared.

What Is an Increase in Retained Earnings in a Cash Flow Statement? | cozosen.web.fc2.com

That is the first item added into the Statement of Retained Earnings. Our retained earnings statement is now going to look like this: Subtract Dividends that your Company Pays out to Investors Does your company pay dividends?

If it does, you subtract the amount of dividends your company pays out of net income.

Let's say your company's dividend policy is to pay 50 percent of its net income out to its investors. Prepare the Final Total for Retained Earnings for Subtract out the dividends, if you pay dividends, and total the Statement of Retained Earnings.

This is the amount of retained earnings that you post to the retained earnings account on your new balance sheet. Net Income 10, Total: A security is a tradable asset of any kind. Securities are broadly categorized into: Debt securities include government bonds, corporate bonds, municipal bonds, preferred stock, collateralized securities such as CDOs, CMOs, GNMAs and zero- coupon securities.

The interest rate on a debt security is largely determined by the perceived repayment ability of the borrower; higher risks of payment default almost always lead to higher interest rates to borrow capital. Also known as "fixed-income securities. An instrument that signifies an ownership position called equity in a corporation, and represents a claim on its proportional share in the corporation's assets and profits.

Ownership in the company is determined by the number of shares a person owns divided by the total number of shares outstanding. Most stock also provides voting rights, which give shareholders a proportional vote in certain corporate decisions. Only a certain type of company called a corporation has stock; other types of companies such as sole proprietorships and limited partnerships do not issue stock.

The paying off of debt in regular installments over a period of time. The deduction of capital expenses over a specific period of time usually over the asset's life.

More specifically, this method measures the consumption of the value of intangible assets, such as a patent or a copyright.

While amortization and depreciation are often used interchangeably, technically this is an incorrect practice because amortization refers to intangible assets and depreciation refers to tangible assets. Accounts on a balance sheet that represent liabilities and non-cash-based assets used in accrual-based accounting.

These accounts include, among many others, accounts payable, accounts receivable, goodwill, future tax liability and future interest expense. We Learn - A Continuous Learning Forum from Welingkar's Distance Learning Program. Start clipping No thanks. You just clipped your first slide!

statement of cash flow and statement of retained earnings.

Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips.

Visibility Others can see my Clipboard.