Margin call currency trading

In this article, we are going to explain the term and give the tips how to avoid the margin call. So what is a margin call? The margin call most frequently happens with a move to close your positions.

Technically, it is important to keep the value of the account higher than the maintenance margin level, otherwise your positions will simply be closed and this will result in a loss for you. Sometimes giving up on your trade and facing a loss is the right thing to do, but if your vision is different — you can avoid a margin call by adding more funds to your trading account. Unfortunately, many brokers can issue the margin call without informing you about their intentions.

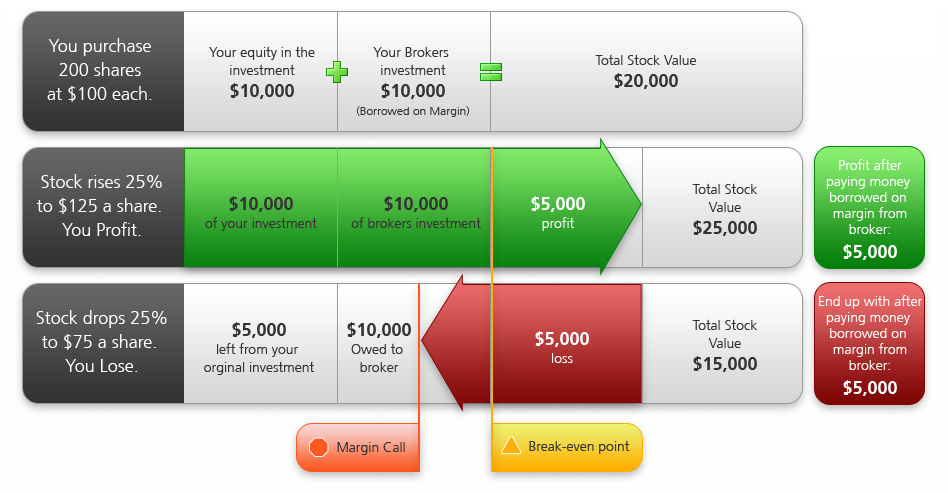

Thus, they automatically close the respective trade s. What is specific about margin accounts is that they enable traders to make investments with their broker's money.

In other words, margin accounts use leverage and can consequently magnify gains. However, losses are magnified as well. As a consequence, if you do not meet a margin requirement, your broker has the full right to close your open trades, starting from the one with the highest loss, in order to increase your account equity until you are above the necessary level of the maintenance margin.

A broker does not even need to consult you before closing the positions. Usually, the right of closing your trades without waiting for you to meet the margin call is stated in a service agreement. As a result, you are highly recommended to read your broker's service agreement very attentively before investing your money.

In this agreement you will see all of the terms and conditions of the margin account. Such information often entails how interest is calculated, how the assets you buy serve as collateral for the leverage provided and more.

Well, the margin call is the difference between your current equity balance in the trading account and how much equity you require to maintain your open positions. Even though you can make the calculation process by yourself, you can significantly economize time by making good use of the margin call calculator.

Margin in Forex trading. Margin level vs Margin call

It determines the hypothetical rate at which a possible margin call may occur. You will be shown the necessary margin in order to keep your position open. Once your margin drops below this level, the position will be closed. As the figures strongly depend on the settings of your account and the data from a particular trade, we always recommend to use our Trader's Calculator before you open an order.

Although the margin call calculator is a nice tool, it is intended only for rough estimates and cannot predict the margin call with sniper accuracy.

Rates used by the tool may be delayed by about 5 minutes. Another important detail is that most calculators presume that no other trades are open in your trading account. However, Alpari tries to supply you with the best tools available, this is why our calculator supports multiple positions. Do not forget that rates used in calculators are usually the average between the 'bid' and 'ask' prices for any given trade.

If we combine all the causes of the margin call together into a list, the main reason that leads to the margin call is the following: To tell the truth, proficient traders almost never experience margin calls.

Did Margin Trading Crash the Price of Bitcoin?

They manage their trades well enough and apply different steps. So let's take a closer look at them.

Become an author of a Forex article and earn bonus points! Alpari is a member of The Financial Commission , an international organization engaged in the resolution of disputes within the financial services industry in the Forex market. Before trading, you should ensure that you fully understand the risks involved in leveraged trading and have the required experience.

Privacy and refund policy Copyrights Anti-money laundering policy. We're sorry, an error has occurred. Please try again later.

Notification of this error has been sent to our technical support team.

Margin Call. Money Management | cozosen.web.fc2.com

To be redirected to the European Alpari website, operated by Alpari Europe Ltd. To remain on this page, click Cancel.

It appears that JavaScript or cookies are currently disabled in your browser. You will need to enable them in your browser settings to activate certain features on our site.

It's our 18th anniversary! Alpari Cashback Premium Client status Special offers and promotions Receive bonus points for articles FAQ. Independent trading Fund management Trading signals MetaTrader trading platforms Trading conditions Contract specifications Margin requirements Order execution settings Deposit and withdrawal options Trader's calculator FAQs. Trading terms Types of binary options BinaryTrader platform Deposit and withdrawal options Binary options FAQs Mobile binary options trading with Alpari Options.

Forex Education Forex courses Timetable Our Teachers Beginners About Forex Demo account Glossary Articles about Forex Our videos Published by Alpari. Beginners About Forex Demo account Glossary Articles about Forex. What is a Margin Call? Why does a Margin Call matter? Therefore, it is imperative to consider the margin call before trading on margin account. How to calculate the Margin Call Well, the margin call is the difference between your current equity balance in the trading account and how much equity you require to maintain your open positions.

Let's explain how to use the typical margin call calculator: Select your account type, as different accounts come with different sets of instruments and other parameters; Define the leverage of your account, this depends on your account settings and your current balance; Pick your account currency; Choose the currency pair of a particular trade; Enter the volume of your trade s ; Define the action, i.

What can lead to a Margin Call and how to cover it?

You can choose between 2 ways to cover the margin call: You can deposit more money into the account to increase your equity; or You can sell enough assets from your portfolio so that your equity balance meets the margin requirement. What are the best ways to avoid the Margin Call? First of all, monitor your account on daily basis. In addition, do not forget to use stop loss orders to reduce your risk exposure. Effective money management increases your chances to avoid the margin call.

You might also consider that one of the best ways to avoid margin calls is not to use leverage. As alternative, you can keep your use of margin at the low end of your borrowing limit.

Thereby, you will have some leverage to improve your performance in a risky market, yet enough to avoid triggering a margin call. Another step you can take is to review your portfolio composition. If you diversify your portfolio across a broad range of shares or managed funds, you can potentially mitigate the risk of receiving a margin call in times of high volatility.

Leverage and Margin Calls Explained - Forex Trading

It is advisable to set your personal trigger. This means that you should keep additional liquid resources at the ready if you need to add either money or securities to your margin account. The best authors work with us Become an author of a Forex article and earn bonus points! Get closer to the target with Alpari analysis Most recent analyses.

Alpari sponsorships Safety and security of funds Media contacts info at alpari dot com Alpari informers Sitemap.

Open a trading account Make a deposit. Data can not be shown. We can speak with you in the following languages: