Probability calculator options trading

The Probability Lab tool is provided for general information and education purposes only and is not intended for trading purposes. The Probability Lab tool is not intended to provide investment advice or recommendations to purchase or sell securities.

Interactive Brokers is not affiliated with Chicago Board Options Exchange, Incorporated or any of its subsidiaries or affiliates collectively, "CBOE". CBOE is not involved in any manner with any account you may have or establish with Interactive Brokers. CBOE is not responsible for or liable with respect to any use of any Interactive Brokers products or services. I will introduce the following concepts: Probability distribution PD The nature of stock prices You can calculate the PD from option prices and vice versa PD implied by the market and your opinion The best trades and potential consequences Please feel free to skip the parts you already know.

Free Probability Lab for non-customer Probability Lab Demo for US stocks. Download Probability Lab for Android mobile. The first concept to understand is the probability distribution PD , which are just fancy words for saying that all possible future outcomes have a chance or likelihood or probability of coming true. The PD tells us exactly what the chances are for certain outcomes. We can take the temperature readings for November 22 for the last hundred years.

Draw a horizontal line and mark it with 16 to 30 degrees and count how many readings fall into each one degree interval. It works out that way because we took readings. Otherwise you must multiply by and divide by the number of data points to get the percentages. In order to achieve greater accuracy we would need more points, so we could use data for November 20 through Let us draw a horizontal line spanning each one degree segment at the height corresponding to the number of data points in that segment.

If we used data from November 20 through 24 we would get more data and greater accuracy but would need to multiply by and divide by These horizontal lines compose a graph of our PD. They indicate the percentage likelihood that the temperature will be in any one interval. If we want to know the probability that the temperature will be below a certain level, we must add up all the probabilities in the segments below that level. In the same way we add up all the probabilities above the level if we want to know the probability of a higher temperature.

Please note that the sum of the probabilities in all segments must add up to 1. If we had more data we could make our PD more precise by making the intervals narrower, and as we narrowed the intervals the horizontal lines would shrink to points forming a smooth bell shaped curve.

Just the same way as future temperature ranges can be assigned probabilities, so can ranges of future stock prices or commodities or currencies. There is one crucial difference however. While temperature seems to follow the same pattern year after year, that is not true for stock prices which are more influenced by fundamental factors and human judgment. So the answer to the question, "What is the probability that the price of ABC will be between The information we have to work with is the current stock price, how it has moved in the past and fundamental data about the prospects of the company, the industry, the economy, currency, international trade and political considerations and so on, that may influence people's thinking about the stock price.

Forecasting the future stock price is an imprecise process. Forecasting the PD of future stock prices seems to allow more flexibility, or at least we become more aware of the probabilistic nature of the process.

The more information and insight we have the more likely we are to get it right. The prices of put and call options on a stock are determined by the PD but the interesting fact is that we can reverse engineer the process.

10. How to Price Options Based on Implied and Historical VolatilityNamely, given the prices of options, a PD implied by those prices can easily be derived. It is not necessary that you know how and you can skip to the next section, but if you would like to know then here is one method that any high school student should be able to follow. What is the percentage probability that the price will be between and at the time the option expires about a month from now?

Provided that options are "fairly" priced, i.

That will be a small number, so that you will not make too great an error. If you've read this far then you will also be interested to know how you can derive the price of any call or put from the PD. For a call you can take the stock price in the middle of each segment above the strike price, subtract the strike price and multiply the result by the probability of the price ending up in that segment.

Summing all the results gives you the call price. For puts you can take the stock price in the middle of each interval below the strike, subtract it from the strike and multiply by the probability.

Again, add all the results together to get the price of the put. Some may say that these are all very sloppy approximations. Yes, that is the nature of predicting prices; they are sloppy and there is no point in pretending otherwise. Computer geeks with complex models appear to the uninitiated to be doing very precise calculations, but the fact is that nobody knows the probabilities and your educated guess based on your understanding of the situation may be better than theirs based on statistics of past history.

Note that we are ignoring interest effects in this discussion, but with current interest rates, that is a small effect. We are also adjusting for the fact that options may be exercised early which makes them more valuable.

When calculating the whole PD, this extra value needs to be accounted for but it is only significant for deep-in-the-money options. By using calls to calculate the PD for high prices and using puts to calculate the PD for low prices, you can avoid the issue. Given that puts and calls on most stocks are traded in the option markets, we can calculate the PD for those stocks as implied by the prevailing option prices.

I call this the "market's PD," as it is arrived at by the consensus of option buyers and sellers, even if many may be unaware of the implications. The highest point on the graph of the market's implied PD curve tends to be close to the current stock price plus interest minus dividends, and as you go in either direction from there the probabilities diminish, first slowly, then more rapidly and then slowly again, approaching but never quite reaching zero.

The ForwardPrice is the expected price at expiration as implied by the probability distribution. Click the image below to view a larger version. The curve is almost symmetrical except that slightly higher prices have higher probability than slightly lower ones and much higher prices have lesser probability than near zero ones. That's because prices tend to fall faster than they rise and all organizations have some chance of some catastrophic event happening to them. In the Interactive Brokers Probability Lab SM Patent Pending you can view the PD we calculate using option prices currently prevailing in the market for any stock or commodity on which options are listed.

All you need to do is to enter the symbol. This is a live PD graph that changes as option bids and offers change at the exchanges.

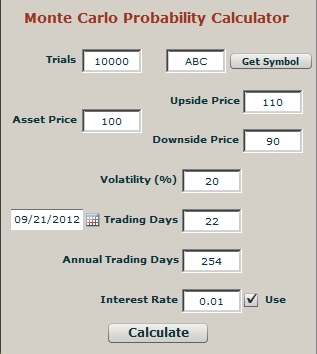

Options Trading: Trade Probability Calculator

You can now grab the horizontal bar in any interval and move it up or down if you think that the price ending up in that interval has a higher or lower probability than the consensus guess as expressed by the market. You will notice that as soon as you move any of the bars, all the other bars will simultaneously move, with the more distant bars moving in the opposite direction as all the probabilities must add up to 1.

Also notice that the market's PD remains on the display in blue while yours is red and the reset button will wipe out all of your doodling. The market tends to assume that all PDs are close to the statistical average of past outcomes unless a definitive corporate action, such as a merger or acquisition, is in the works.

If you follow the market or the particulars of certain stocks, industries or commodities, you may not agree with that. From time to time you may have a different view of the likelihood of certain events and therefore how prices may evolve. This tool gives you the facility to illustrate, to graphically express that view and to trade on that view. If you do not have an opinion of the PD as being different than the market's then you should not do a trade because any trade you do has a zero expected profit less transaction costs under the market's PD.

The sum of each possible outcome profit or loss in each interval multiplied by its associated probability is the statistically Expected Profit and under the market's PD, it equals zero for any trade. You can pick any actual trade and calculate the expected profit to prove that to yourself.

Thus, any time you do a trade with an expectation of profit, you are taking a bet that the market's PD is wrong and yours is right. This is true whether you are aware of it or not, so you may as well be aware of what you are doing and sharpen your skills with this tool. Please go ahead and play with the PD by dragging the distribution bars below.

We display combination trades that are likely to have favorable outcomes under your PD.

You can specify if you would like to see the "optimal trades" that are a combination of up to two, three or four option legs. We will show you the three best combination trades along with the corresponding expected profit, Sharpe ratio, net debit or credit, percentage likelihood of profit, maximum profit and maximum loss and associated probabilities for each trade, given your PD, and the margin requirement.

The best trades are the ones with the highest Sharpe ratio, or the highest ratio of expected profit to variability of outcome.

Please remember that the expected profit is defined as the sum of the profit or loss when multiplied by the associated probability, as defined by you, across all prices. On the bottom graph you will see your predicted profit or loss that would result from the trade and the associated probability, corresponding to each price point.

The interactive graph below is a crude simulation of our real-time TWS Probability Lab application available under the Trading Tools menu, to our customers. Similarly, the "best trades" are displayed for illustrative purposes only. Unlike in the actual application, they are not optimized for your distribution. When you like a trade in our TWS application, you may increase the quantity and submit the order. In subsequent releases of this tool we'll address buy writes, rebalancing for delta, multi-expiration combination trades, rolling forward of expiring positions and further refinements of the Probability Lab.

Please play around with this interactive tool. As you do so, your understanding of options pricing and your so called "feel for the options market" will deepen. Interactive Brokers LLC is a member of NYSE , FINRA , SIPC.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. Options involve risk and are not suitable for all investors. For more information read the "Characteristics and Risks of Standardized Options". For a copy visit Interactivebrokers. TradeStation Voted Best for Options Traders 2 Years in a Row by Barron's.

Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options ODD. Copies of the ODD are available from your broker or from The Options Clearing Corporation, One North Wacker Drive, Suite , Chicago, Illinois The information on this website is provided solely for general education and information purposes and therefore should not be considered complete, precise, or current.

Many of the matters discussed are subject to detailed rules, regulations, and statutory provisions which should be referred to for additional detail and are subject to changes that may not be reflected in the website information. No statement within the website should be construed as a recommendation to buy or sell a security or to provide investment advice. The inclusion of non-CBOE advertisements on the website should not be construed as an endorsement or an indication of the value of any product, service, or website.

The Terms and Conditions govern use of this website and use of this website will be deemed acceptance of those Terms and Conditions.

How to use Probability Calculators with Options Trades | cozosen.web.fc2.com

My Account Account Settings Sign Out. CBOE Trading Tools Virtual Trading Tools Strategy Planning Tools Calculators COBWeb Strategy Planning Tools Strategy Planning Tools Term Structure Data TradeBuilder with Trade Analyzer Volatility Finder Volatility Optimizer Tradespoon Trade Idea Tool Probability Lab. I am Thomas Peterffy, founder of Interactive Brokers. I will tell you about a practical way to think about options without complicated mathematics.

Free Probability Lab for non-customer Probability Lab Demo for US stocks Download Probability Lab for Android mobile. What is the probability that the daily high temperature in Hong Kong will be between STOCK PRICES Just the same way as future temperature ranges can be assigned probabilities, so can ranges of future stock prices or commodities or currencies.

OPTIONS AND HOW THEIR PRICES IMPLY A PD The prices of put and call options on a stock are determined by the PD but the interesting fact is that we can reverse engineer the process. THE PD AS IMPLIED BY THE MARKET and YOUR OPINION Given that puts and calls on most stocks are traded in the option markets, we can calculate the PD for those stocks as implied by the prevailing option prices.

Click the image below to view a larger version The curve is almost symmetrical except that slightly higher prices have higher probability than slightly lower ones and much higher prices have lesser probability than near zero ones. Free Probability Lab for non-customer Probability Lab Demo for US stocks Download Probability Lab for Android mobile In subsequent releases of this tool we'll address buy writes, rebalancing for delta, multi-expiration combination trades, rolling forward of expiring positions and further refinements of the Probability Lab.

Sincerely, Thomas Peterffy CEO Interactive Brokers "Even though he has essentially developed a proprietary formula that is the financial equivalent of Coca-Cola, Peterffy is giving away the animating power to anyone who takes the time to study probabilistic thinking and explore his lab. Sears, "Peterffy's Latest Creation" from the November 18, edition of Barron's.

Using a Probability Calculator - Investment U

Related Links Intra-Day Volume Options Calculator CBOE TV Strategies Uncover Powerful Outcomes. CBOE Links Government Relations Investor Relations CBOE Livevol Data Shop Livevol CBOE Media Hub System Status Chinese Language Site Risk Management Conference Careers Advertise with CBOE CBOE.

Other CBOE Sites CBOE Futures Exchange C2 Exchange Trading Permit Holders. CBOE Options involve risk and are not suitable for all investors.