Stock market crash theories

It took seeing it over and over for me to accept that it was not a fluke; no outlier, just human nature. I think almost all mistakes as they pertain to the stock market come down to a handful of things:. It happens because older investors die, younger investors join the workforce, and those still taking part have largely recovered the prior damage, forgetting the pain the same way an alcoholic relapses or a spendthrift starts taking out the credit card, starting the cycle all over, again.

I cannot sufficiently underscore how idiotic this is. Provided the businesses are good, the earnings sufficient, and the dividend or buybacks flowing, this should not be seen as a problem, it should make you excited more on that when we discuss the effect of the Great Depression recovery period in a moment. You have no business owning stocks. If you need to understand the reason, go read this case study comparison examining the results of Coca-Cola and PepsiCo, especially in light of the crash.

Wall Street is bound by the super power of incentive and other institutional constraints to deliver products and services that are destined to underperform after-fees, taxes, and expenses because of the first two theories. The tax strategy, asset protection potential, and estate planning options alone — not to mention the significant reduction in risk in the underlying portfolio itself given the emphasis on firms that could survive another Great Depression event — made the 0.

Vanguard provides a similar, albeit less personalized and tax efficient, service. Once you move beyond a typical middle class family, your needs become more complex and sophisticated. You have to look at the all inclusive service costs of the entire investment management process. Had Buffett himself not been doing the structural work, his estate plan would have cost a hell of a lot more to execute than people seem to think.

Pass away, your spouse remarries then dies in a car crash? Their step-parent just inherited the entire estate and can now leave it to that year old he or she was banging as they squander your life accumulation in Vegas. You bought that boat directly, in your name, rather than setup a company to own it and lease it to you as a customer?

Yeah, good luck with that when your kid gets drunk and kills someone. A small amount upfront can save entire fortunes down the road once you become a target. Vanguard is not trying to rip you off. In fact, you should send your trustee flowers for watching out for you at such a cheap price following your death. Include a note with it: The peace of mind and efficiency you are offering is terrific. The way, for example, he lowered his personal estate tax?

Look at the whole picture. I mean, read this series of comments that was gilded multiple times on Reddit, with thousands and thousands of upvotes saying what a normal person should do if he or she won millions of dollars in a lottery. Let me check with someone more experienced. There is no shame in that. The stuff about not paying a private bank to manage the money while simultaneously encouraging the winner to set aside money in trust for family members … yeah, good luck with that.

A good example comes from a small, vocal minority of people who adhere to the philosophies of someone for whom I have tremendous respect — John Bogle. It was — and is — an elegant, simple solution to the investing problem, as presented. It creates a paradox of sorts, too. Pointing out the error could do them harm, therefore, it might be immoral. This is not a difficult decision. Which, again … means index funds are the best option for them.

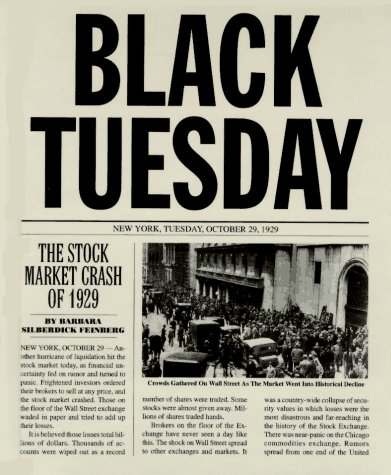

It really is a rather marvelous paradox. Stop and think about what would have happened if you lived through the Great Depression and bought in at the top.

Penney was yielding In , , , and , your ownership kept getting bigger as a percentage of the pie; those whopping dividend yields allowing you to gobble up far more equity so that your cost basis was drug down.

The same reason we have click-bait infotainment on websites like CNN, demonstrating the fall of once great journalism standards, folks want easy-to-digest maxims that make up in pithiness what they lack in accuracy. They want their ears tickled. Even if they were somehow open to it, we now live in a world where information is determined based on search engine rankings that encourage short-term thinking and page views rather than reflection.

Welcome to the do-it-yourself economy. The older I get, the more dangerous I think it is, especially from a social and political standpoint. I had my mothers IRA money invested in American Funds , Stock funds only.

In she turned She was very nerves and wanted to move her money out I told her that market history has shown that it will recover. And do you know of a web site where I can back test systematic withdrawals from different stock mutual funds?

Assume that she bought something like the Vanguard admiral class index fund shares. She would have been holding 1, Open a spreadsheet and manually calculate how many shares would need to be sold, at the price in effect on that date, for each RMD, while simultaneously crediting dividend reinvestment on each dividend date for something this simple, and since it was less than 20 years ago, you can get away with using something like the Yahoo Finance history tool , even though it has some programming quirks that make longer-term analysis much less reliable.

If you have the spreadsheet keep a running total, you could see how her account balance fluctuated over time and, upon arriving at the present day, know roughly what her account balance would have been relative to what it is now.

As for your question: You might want to try playing around with it. She is going to help out her son and his family because she wants to see some of the good works she is doing while alive.

Right now aunt Martha has nothing in that particular account.

Stock market crash - Wikipedia

Todd- you are right to see that it pays to have some diversity and maybe hold some cash. I wonder how many folks will lulled into thinking the INDEX is the be all and end all. I wonder how many bubble stocks are now in that index? Sure were a lot in March of It appears that the image, habits and lives people have created for themselves, regardless of how flawed they may be are excused for the simple reason that the person himself has created this image. He built those habits. He built those maxims he lives by.

It has become a mental offspring that has personal value beyond any physical possession. Those habits and personal truths have become his own reality despite information and data that might prove him wrong.

The ability to objectively ask ourselves clear, though painful questions regarding our current skill set, knowledge base, patterns and temperament and then to follow it up with honest answers and life adjustments is an extremely difficult task for many.

I sat with a guy and calculated that he was actually losing money per year from driving Lyft and Uber when factoring in the fee those companies charge their drivers plus his total insurance, repairs, fuel cost etc.

He still continued to drive until his he got in an collision costing him even more money. Maybe get back in later with more knowledge or switch to safer investments. To get to the point where you are even presented with the latter choice — to sell or not sell — without knowing the answer is only possible due to the earlier failure.

There seems to be a misunderstanding. One of the professors at Wharton went so far as to turn the findings into a couple of New York Times bestselling books in which he simplified the math for the general public. The longest, and worst, was the infamous collapse. If you had put everything in at the absolute peak of the market in , it would have taken 8 years to get your purchasing power back due to the runaway inflation that hit the U. The dividends accelerating your return as stock prices collapses were swamped by Congress printing money.

On the other hand, if you were still dollar cost averaging, the recovery was a mere fraction even then because your cost basis was drug down. My point was the argument you made was incomplete not wrong. What is the name of the Wharton professor?

No worries, I understand, completely! The amount of time and effort they went to in order to prove it beyond a shadow of a doubt was monumental. I know this is going to sound a bit like hyperbole but I mean it quite literally: Make an effort to read his entire research body of work going back the past few decades.

Some of the really interesting stuff is in the subsequent performance of peak market acquisitions when confined to high quality enterprises e. He also makes some powerful arguments for fundamentally-weighted index methodology over the more common market-capitalization weighted strategy. The two books he wrote for laymen are fantastic, both of which are available on Amazon. I am sure Joshua has had a company blow up on him. But having a well balance portfolio one can survive a market crash and is no reason to be out of the market before, during or after a market melt down.

As my early post shows even with systematic withdrawals one will recover. Note my mother started taking out about 3. Even when everything seems to be right there can be things you miss. Like underestimating the power of technological change.

The power of the kindle to transform an industry. Please let me know how to send it. Sorry about everything being a bit of a mess during the upgrades and redesign. You can go to this page and fill out the form, press the button at the bottom, and it will make sure the message makes its way to the inbox. Thanks for letting me know, again. Also, wow, clicking on links on that page made me find out about the big business news.

Exciting — and congrats on making that big decision! I also once likened passive indexers to a sort of parasite because they essentially free ride on the collective wisdom of active market participants. The thing that interests me is the effect on passive investment returns , all else the same, as the ratio of passive to active investment dollars increase. I wonder how big passive can go until it becomes better for the average investor to go active.

Indexing seems to have caught a huge wave of popularity in the last 5 years so we might get to see what happens when we get to a substantial level of indexing.

When do the indexers start creating their own momentum through massive herd buying during the majority DCA phase and selling during the majority withdrawal phase. I love this kind of stuff! I recall coming across that particular thread and it makes me sad that the dogma that reigns over some people hinder them from not being able to have rational, reasoned discussions instead acting like raising questions and facilitating discussion is like some sort of personal attack that has to be dealt with through emotion.

On a bright note all of this behavior is what makes market inefficient. I admit to have found the Reddit lawyers advice quite reasonable. In other words, a good tool to have, but highly unlikely for most of the populace.

The first time I read through that it looked sort of okay on the surface although I know about the wealthy Mr. Whittaker and the redditor sugar coated it so that was a red flag. Another glaring problem even to a simpleton like me is he only discusses two types of investments- stocks and government bonds -and seems to indicate any other financial advice as a cheat or scammer.

A lack of diverse investments and just having a large stash of cash lying around instead of a bunch of businesses is not a recipe for long term wealth — ala nearly every professional athlete.

Additional safety in that this extra income could be basically kept a secret from people who might hound those receiving it stealth wealth. My biggest observation regarding investor behavior was referenced in your point 8 under theory 1: I think the biggest factor working against investors is the lack of correct temperament.

Especially with the constant information deluge being thrown at them — something they should opt out of as to not overreact to news and resort to trading instead of investing.

Stock market rigging is no longer a ‘conspiracy theory’ | New York Post

Think about the bygone eras where a casual investor might have only had access to the news through a newspaper, and then more recently radio and TV. Nowadays, due to the rise of talk shows, internet alerts, social networks, and smartphone apps, a casual investor can literally be tuned in every waking minute of his life. I only see 4 in the article. I think you hit the nail on the head with your comments about temperament being the biggest factor working against most investors.

It is very difficult for most people to tune out the constant barrage of stock quotes and sensationalistic media coverage of the market, and instead focus on the underlying business. Joshua, really off topic but the article was just released today or within the past 3 days and I wanted to get your thoughts — if you have the time to read through: And yes, this includes dividends!

As you point out, dividend yields did get very impressive for a brief period in , but it was not sustained. They quickly fell back to earth. One would really have to cherry pick the data to come to your conclusion. Am I missing something or are you trying to make the case that the buy and hold investor always does swell. I really wish this were true, but its just not…. But what about the gal who decided to retire in ?

Explanations for the Black Monday stock market crash - Business Insider

She really does have a long, long horrible wait to re-establish her previous high water mark…. It only works if you assume dividends are reinvested and adjust for changes in the value of the currency e. That piece was written in April of , a month after the market had collapsed and people had thrown in the towel with what seemed like half of Wall Street going into bankruptcy or near bankruptcy.

This includes the assumption that dividends were reinvested. While its true the market enjoyed a great bounce following the crash, it was not sustained in inflation adjusted terms. When you find yourself arguing with arithmetic, you should stop arguing and ask yourself why you are in that position. There is an SP calculator on http: It can adjust for inflation and dividend reinvestment.

Depending on what month you invested in and what month you could have had a negative return even including inflation and dividend reinvestment, for example September to June I find it astonishing, to some degree, that the very phenomenon I wrote about it playing out in the comment section of this blog right now.

That is the statement that has been made. That is the statement that can be proven either true or false by the math. Nobody gets to have a personal opinion on it. Cracking open my own copy, it looks roughly right — total return was positive from by sometime around While the economy had undergone a now-forgotten struggle not entirely related to the earlier problems, from September to September , the twenty years you mentioned, the composite with dividends reinvested actually compounded at … 0.

Is it something useful? If you had never saved another penny beyond dividend reinvestment, and managed to put your money in the stock market as one big lump sum when things were trading at once-in-multiple-generations ridiculous valuations, then … yeah, your recovery, though initially quick to arrive, was cut short due to a later, second collapse that happened and nobody now remembers. Who behaves like that?

A vast majority of investors go through their lives buying ownership as they get older, accumulating. The people who accumulated through that period still got rich. In fact, the September of investor who held on for 30 years, not the 20 you seem intent on measuring because it is the only way you can get your thesis to work, would have had real purchasing power gains of 5.

The only industry somewhat reasonable priced was oil at 17x earnings. Even in the greatest crash of our memories, you would have been back at par in just a few years if you simply had faith in the buy-n-hold strategy. And the reason is precisely because there is a lot of truth to the very statement you were mocking in your original post when you said:. I don't believe this statement is at all foolish. I actually think its very well informed and tends to guide my own stock allocation decisions to this day.

This made me crack up Joshua. I for one would pay for the comments section alone. Google Pioneer Fund returns since This is what I found Starting with dollars invested. I like to use real life examples. I like looking at old Stock Mutual funds to see how they did in so called bad times.

Just give me a steady or raising Dividends. That what Ronald Read did. What are the risks of a U. However, it appears to be necessary to understand the answers to these questions and a lot more prior to owning any substantial position in Yahoo, which partially owns Alibaba Holdings. How many people who own Yahoo actually understand this? Do they understand the Chinese law adequately, such as the precedent in VIE companies of the Minsheng Bank case, or the case of Walmart being stopped by the Chinese merger authority from using a VIE to acquire a stake in Yihaodian, a Chinese retailer?

How thorough is their understanding of the U. IRS Section tax law, which governs corporate spinoffs? How many people in the world can honestly say that they understand these arcane legal areas sufficiently well?

Certainly fewer than the number of Yahoo shareholders. How can one even consider such an investment without asking and having well-researched answers to these questions? Dear Joshua, wow — this piece is so loaded with content, I love it!

The index or die crowd is obnoxious. But it is nice to know what is at the next level, just in case. We have 3 kids and Iove when you talk about legacy. Thanks for sharing your knowledge and thoughts. So many responses were along the same dogmatic lines that you mentioned. Which asset did the best. Perhaps if your wealth were far above the 8 figure mark, you would get more benefit from different advice, but this seems to be a great starting map for someone who is trying to learn how to put their financial life together.

I followed the opening link and this is what Adams had to say about his own advice: For the most part he does. The best-selling author says he invests primarily in municipal bonds today, which are tax-exempt, and also owns land in his adopted home state of California.

I do not like it when people set arbitrary hard rules and then command others to follow them. I think that is arrogant. And what if, as is the case with many k s out there, there is only junk in there? In that case, it is possible the best choice is to invest up to the match and no more.

It may work most of the time, but it rubs me the wrong way. I see it as the responsibility of the advice taker to dig further.

It looks like the Ten Commandments or something! Or laws mandated by the government. I think you missed the point about Trusts. Joshua has spoken to it much better than I could. How do you find a good lawyer to do a trust? Maybe I am now miss reading what he is saying Will — Check Large Term Life Insurance Policy super cheap — Check Trust — No Check.

I have no idea where to start. The few lawyers I have talked to have talked presented fees so large I walked away. I get intimidated easily I guess. Steve, how large is your term policy?

Some folks say 10x annual income but we are really just around 5x. What did you choose to do and why? Will — no Life insurance — minimal Disability insurance — no doh! Healthcare power of attorney, etc — no. I used to be on the young side to worry about it but the years are advancing quickly, so quickly! I am not sure I understand about trusts because I thought Joshua was talking about tax savings in the article.

I get that there is an element of control and stewardship and that is great. I obviously have other work to take care of before thinking of trusts. For the will, I need to start a relationship with a lawyer would you do a DIY will for a basic family? Maybe that would be a fine start. Need to set a deadline to get these things settled and cared for. What am I missing?

This is for Joshua to, Has there every been a equity market in the world ever shut down for good or long periods of time say months.

Wall Street Crash of - Wikipedia

How would people pay you there rent. If equities had no value that would mean banks would be closed. Think about equities are part of a economic food chain if they go the chain breaks. Only ones ability to grow food would survive. Call me crazy I am sticking with equities. Dividend payers of course.

The real threat to ones money is there spending habits. Including right here in the United States. The biggest example is July 31st — November 27th, , when the stock exchange remained closed to investors who wanted to buy or sell due to the breakout of World War I. Such a thing was unthinkable even back then but it happened.

The last major closure in the United States was the September 11th terrorist attacks. Stock markets can and are shut down locking investors out of liquidity for extended periods of time without spreading to real estate or banks. And why he augmented his substantial Berkshire Hathaway fortune with major real estate holdings, too. It drastically reduces portfolio volatility and, in the event of a Great Depression providing credit quality is good, the deflationary environment means they appreciate in real purchasing power, giving you a stream of interest to buy up now-firesale-priced stocks.

In , for example, a secondary gray market — if you want to call it that — developed where private buyers and sellers would get together and manually exchange ownership stakes based on negotiation.

If you owned a building, you could swap someone a year worth of rent for blue chip shares worth 5x that amount were you inclined to be avaricious. People need food, shelter, medicine, and defense far more than they need stock certificates. I guess I am crazy I better fix that. On one hand the efficient markets hypothesis or even simple math would suggest that indexers on average should always outperform active investors on average.

But how stable is the math if the percent of indexers becomes too high? It seems intuitive that this could create some demand shocks and potentially destabilize the pricing system. Because, for example, the active investors could hypothetically all be holding, while the indexers are just relentlessly buying, thus driving prices that were initially established rationally by active investors substantially higher.

Or one could see momentum effects as you mentioned during accumulation and withdrawal phases of savings and retirement. Of course, on average active investors correspond to much of the volume in the stock auction process, so their opinion has a strong weight in price. Whereas index investors tend to have very low volume, so their opinion has relatively little effect on price.

But one could imagine the instabilities might happen more often as more people do indexing, and more trading is done algorithmically, since algo traders tend to stop providing liquidity when there are pricing instabilities e. Corporate governance would be massively spread out, which I think would be a net negative. Corporations have, on average, worked out very well as mini empires with concentrated control over the individual entities.

Then at some point these citizens are allowed to trade their ownership stakes in the index funds and underlying businesses.

On the flip side, because owners do not care, it will be much easier for executives to rob owners through for example, executive stock options. One way to combat this would be to offer some advantage to active shareholders, i.

The reasoning being that a diffused but active ownership still has social benefits over an utterly uncaring ownership.

I wonder whether little perks would already make a difference, e. A good related article by Burton Malkiel from January Until the Socialist influences and rise of Big Gov — mainly with FDR — and the social security scheme, it has always been do-it-yourself.

The problem is they lied. Am I excusing those baby boomers? Something for nothing is so sexy … but I digress. People are just now realizing it. It has nothing to do with the government.

I used work model I stumbled upon from company that i found online and I am so thrilled that i was able to make so much money on the side. Check out what I did… STATICTAB.

To help offset bandwidth costs and other expenses of running a successful blog, the site now features affiliate referrals that convert words into affiliate links that pay us for the transaction. For more information, or if you run a website and want to sign up yourself, visit VigLink. Skip to content Search: Rss YouTube Pinterest Twitter. Thoughts on Business, Politics, and Life from a Private Investor. Stock Market By Joshua Kennon August 16, 78 Comments. We Created a Spicy and Sweet Sausage and Pepper Stir Fry for Dinner.

Thanks for the link, fun web site. Cool — just sent you a test message. Should I move or ask my parents for a bridge loan? Incredible, and Congradulations Mr. Good luck on the new project. Guess it means there are people out there who need to read this more then we do. I enjoyed reading that; thank you for it. That double negative is giving me a nervous tic in a spot untouched by sunlight.

Hi Joshua — Interesting piece. Furthermore is not the only problem period. I actually downloaded Shillers data to verify this unfortunate fact. The NYT article is therefore very misleading. Sam is correct, just download the data and check yourself. It took a bit longer. What's the worse that can happen? But there is a reason why you and I don't behave that way with our own precious dollars. And the reason is precisely because there is a lot of truth to the very statement you were mocking in your original post when you said: I guess a lot of these errors just boil down to over-confidence.

Never ask a barber if you need a haircut. Letter from a Birmingham Jail by Dr. Martin Luther King Jr. Since , Joshua Kennon has been the Investing for Beginners Expert at About. In the going-on two decades since he first published for the network, he has built up a body of work of more than 1, articles, essays, and lessons that are available to read for free, covering everything from how to analyze a balance sheet to strategies for portfolio risk reduction.

More formally structured than the content on this personal blog, they are a fantastic introduction to the basics of wealth building and asset management for new and experienced investors alike.

This is a personal blog intended for academic, educational, and social engagement among members of a like-minded community. Nothing on this site is intended or should be construed as investment advice, financial advice, tax advice, or legal advice.

You are solely responsible for your own financial decisions, agree that you will seek the advice of your own qualified professional advisors, agree that you, and you alone, are solely responsible for any financial consequences or losses as a result of your actions, and use of the site constitutes your agreement that you will not rely upon any information found on the site, including the comments.

All text, images, and resources are provided on an "as is" basis with no guarantee of accuracy and with no obligation to update or correct information. For more information, read the terms and conditions.