Black scholes european call option derivation

European call and put options, The Black Scholes analysis.

Derivation of the Black-Scholes Equation for Option Value A call option is the right to buy a security at a specified price called the exercise or strike price during a specified period of time. A put option is the right to sell a security at a specified price during a specified period of time.

American options can be exercised at any time up to and including the day of expiration of the option. European options can only be exercised on the day of expiration of the option.

Fischer Black and Myron Scholes chose to analyze the simplest case, a European option on a stock that does not pay a dividend during the life of the option.

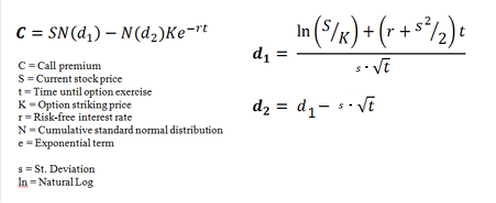

Options Pricing: Black-Scholes Model

They also limited their analysis to conditions which made the problem simpler mathematically. The list of these assumptions will be given later. Let C be the price of the call option.

The functional dependence can then be expressed as: The change in stock price dS is assumed to be given by: Now consider a portfolio containing one written call whose value is -C and h shares of the underlying stock.

The value V of this portfolio is given as: This means that the change in the value of the portfolio dV over the interval dt is: When terms are combined we find that those involving dz cancel out.

DERIVATION OF THE BLACK-SCHOLES EQUATION

Stock broker vs doctor V is independent black scholes european call option derivation the random variable dz; i. Since the value of the portfolio is independent of the random variable it should increase in value at the same rate as the risk free interest rate; i.

This is the Black-Scholes differential equation for call option value. Had we considered the put value P instead of the call value we would have come up with the same equation.

The assumptions made in deriving the Black-Scholes differential equation are: No change in the number of shares of stock outstanding The underlying stock pays no dividends during the life of the option. There exists a risk-free interest rate which is constant over the life of the option.

19. Black-Scholes Formula, Risk-neutral ValuationIndividuals can borrow as well as lend at the risk-free interest rate. HOME PAGE OF applet-magic HOME PAGE OF Thayer Watkins geovisit.

Derivation of the Black-Scholes Equation for Option Value. HOME PAGE OF applet-magic HOME PAGE OF Thayer Watkins.