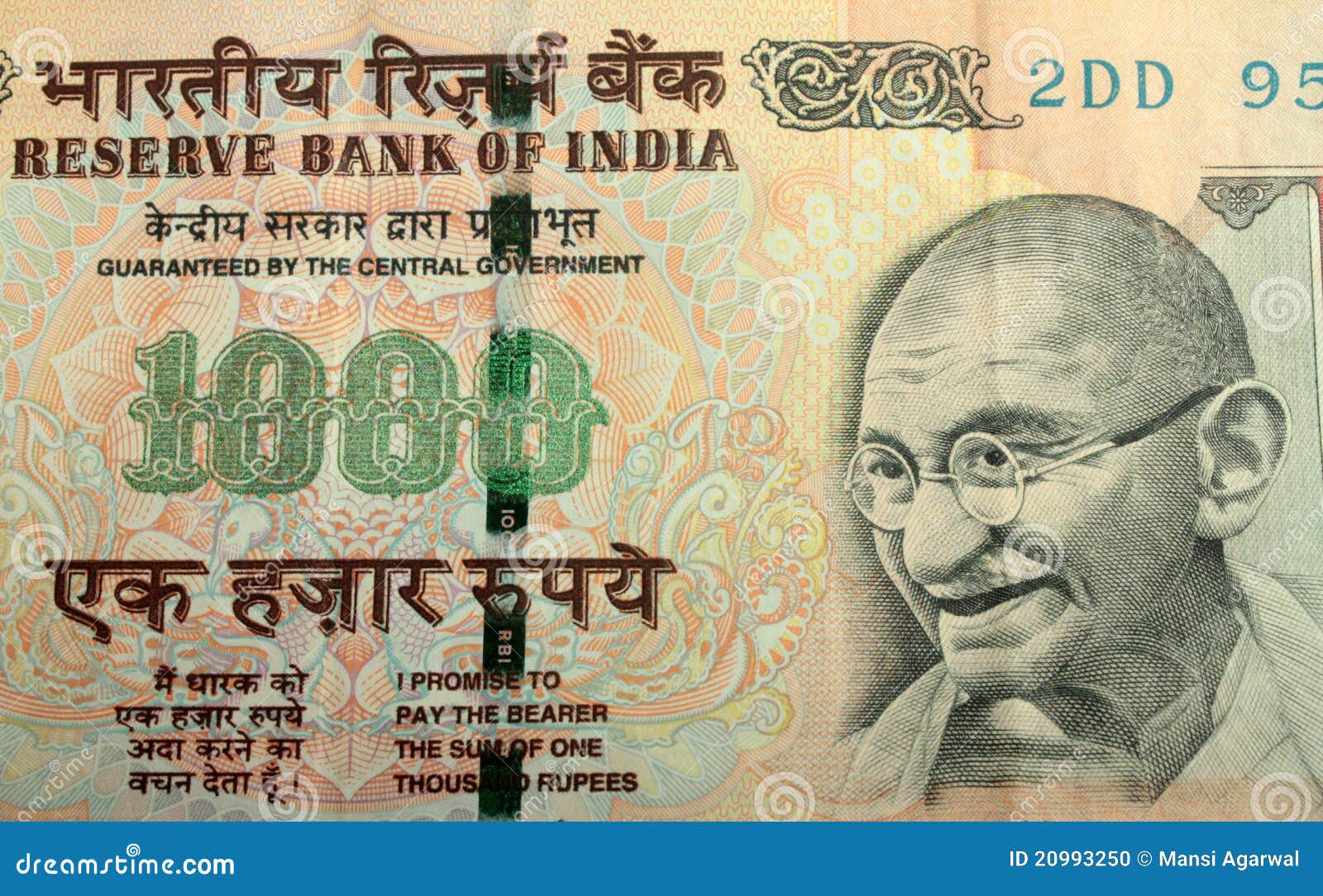

Components of stock market in indian rupee

The gloom surrounding the recent rupee fall has been unnerving for investors. For stock investors, the rupee's roller-coaster ride over the last few weeks has added another layer of uncertainty in a market whose movements over the last few months have anyway been as unpredictable as during any time in recent history.

Experts predict that the rupee may slip further in the days to come.

What does that mean for your portfolio? Is there some way you can gain if that happens? Definitely, you can, if you tweak your portfolio to include stocks in the sectors that might gain from the rupee's fall.

INR stock quote - Market Vectors Indian Rupee/USD ETN price - cozosen.web.fc2.com

These include pharmaceutical and information technology that earn a big part of their revenues in dollars. Every dollar earned through exports means more rupees added to the bottom line. However, let's first tell you why rupee fall is considered bad news.

At a basic level, rupee weakness signals that investors are losing faith in India and exiting their investments here in the belief that their money can earn better returns elsewhere.

This is exactly what happened last month, when the dollar rose after the US central bank, the Federal Reserve, or Fed, hinted at economic recovery in the US and said it might reduce the amount of dollars being injected into the system to support growth.

Foreign investors, already nervous about India's high current account deficit, or CAD, fell for the rising dollar bond yields as a result of the Fed's actions and took money out of India to invest there. As US year Treasury yield rose from 2. But why was the rupee fall so steep? The reason, say experts, is that foreign investors were already edgy about India's finances, especially the large CAD, and took flight at the slightest hint of better opportunity abroad.

Pradeep Gupta, vice chairman, Anand Rathi Financial Services, says countries with huge deficits are usually the worst off in currency sell-offs.

For stock investors, rupee is a key factor to watch out for. A weakening rupee hits India's markets, which are highly sensitive to FII flows. The reason for this is simple. This leads them to the exit door and weakens the rupee further as they sell their India investments and exchange rupees for dollars to invest somewhere else. IT SECTOR IT companies earn most of their revenues in dollars. So, each dollar earned abroad will now get them more rupees.

Pandey of ICICI Securities expects IT companies to post higher revenue growth this year. He expects the average realised rate for the first quarter of to be An industry thumb rule says that every basis points, or bps, rupee movement impacts operating margins of IT companies by bps. However, IT companies may not gain much in the first quarter of as the steepest rupee fall was in June, the last month of the quarter.

Stocks that will help you gain with a falling rupee

This could help revenues and margins in the coming quarters," says Pandey. Though the rupee is coming to the rescue of IT companies, it does not mean that everything is hunkydory for the sector.

Customers, too, will ask for discounts," says P Phani Sekhar, fund manager, portfolio management service, Angel Broking. Prateek Agrawal, chief investment officer, ASK Investment Managers, says rupee fall does little to increase the demand for India's IT exports.

A sharp rise in exports happens only when there is huge spare capacity which, he says, India does not have at present.

Rupee fall pushed up operating profit margins by bps TCS: However, the recent rupee fall may not yield immediate gains. Big gains are likely to flow from the second half of if the rupee remains at the current level. Click here to Enlarge Top Picks Divi's Labs: Rupee fall will add to sales and margins as Divi's is a net exporter.

Falling rupee will add to sales and margins as it is a net exporter. OIL AND GAS SECTOR Experts expect a mixed impact on the sector. Click here to Enlarge The worst-hit will be government oil marketing companies such as HPCL and BPCL. This is because of limited ability to pass on higher crude oil which they import prices to consumers due to price controls except on petrol. The actual impact will depend upon the extent of increase in diesel prices and how much they are compensated by the government for selling fuels below the production cost.

Angel Broking's Sekhar says the Centre has budgeted Rs 80, crore for subsidy-sharing this financial year.

Indian Share Market, Share Market in India

However, with the rupee trading around Rs 59, this will rise to Rs 1,20, crore. Under the formula, the government, upstream oil companies such as ONGC as well as oil marketing companies share the fuel-subsidy burden. In general, for every Re 1 fall in the value of the rupee, under-recoveries, or losses, of oil marketing companies rise by Rs 6, crore. Experts say the cost of servicing foreign currency loans will also rise.

Pandey of ICICI says the impact on ONGC will be minimal as its overseas subsidiary, OVL, which earns in dollars, accounts for A CRISIL report says the impact of higher fuel prices will also be felt on the demand for automobiles. Plus, their ability to pass on higher costs to consumers is limited due to stiff competition in the sector.

Click here to Enlarge Top Picks: However, some of this benefit may be offset by higher outgo on foreign currency debt of Rs 70, crore. The company has high dollar reserves and so will report foreign exchange gains in the current quarter. ICICI Securities says the target price of Cairn India rises by Rs 8 per share for every Re 1 fall in the value of the Indian currency against the dollar.

POWER AND METALS Companies with huge dependence upon imports will be hit by a rise in the cost of inputs. Further, a large number of power companies have borrowed heavily in dollars.

The Adani Group, too, has foreign currency loans amounting to Rs 4, crore. However, metal companies will gain, as they pay import-parity prices for coal.

But experts warn that some metal companies may be hit by unhedged foreign currency liabilities. Pandey of ICICI says profitability of Tata Steel's India operations is likely to rise as the company pays import-parity prices for coal.

Experts are more positive on Hindalco. The company, they say, will benefit from the rupee fall as its realisations are import paritylinked while alumina requirements of its Indian operations are met from domestic sources. However, it is likely to book a foreign exchange loss on account of unhedged foreign currency loans.

Further, a number of auto companies have taken foreign currency loans in the form of external commercial borrowings and FCCBs. For example, Motherson Sumi, a components maker, has a Rs 3, crore loan on its balance sheet. It reported a foreign exchange loss of Rs 64 crore in the third quarter of Click here to Enlarge Tata Motors, too, has foreign currency loans of Rs 3, crore. Like Tata Motors, there are a number of companies for whom exports are a big source of revenue.

Bajaj Auto's margins, for instance, are expected to rise 70 bps quarter-onquarter to The major impact of the rupee fall is likely to be felt by companies that have raised money through FCCBs. Only half this exposure is hedged.

One of the most indebted sectors is telecom. For instance, Bharti Airtel and Reliance Communication have foreign debts of Rs 48, crore and Rs 27, crore, respectively. These loans were taken mainly for speeding up expansion, in Bharti's case the purchase of Zain Telecom in Africa. Though the Indian currency's fall will boost the revenue and operating profit of Bharti's African operations, it will also increase the company's net loss.

Based on an analysis, an 8. INDIRECT IMPACT Some companies will be indirectly hit by the rupee fall.

To start with, the fall will slow economic growth as foreign funds lose confidence in India and take their capital elsewhere. This will compress margins and make it difficult for companies to pay off debts, in turn putting pressure on banks as well. The trend has also postponed the likelihood of a cut in interest rates.

This is because a rate cut will further devalue the rupee. According to Gupta of Anand Rathi, the impact of rupee fall on infrastructure and capital goods companies is relatively low as their contracts provide for cost escalation due to currency movements.

GOING FORWARD According to Gupta, the rupee could bounce back in next two-three months due to government measures and improvement in the CAD. Prasad Koparkar, senior director, CRISIL Research, says demand growth and competitiveness, rather than currency movements, determine growth and profitability. Click here to Enlarge. Previous Story Re fall: How to tweak investment strategy.

How the Stock Market Works: Advantages, Components,Trends

Next Story Tips to invest in retail real estate market. India ready for GST, anti-profiteering rules soon: Hasmukh Adhia Tata Sons to buy Tata Steel stake in Tata Motors TVF CEO Arunabh steps down following sexual harassment charges US bans imports of drug from three Ipca Lab facilities; shares fall Connaught Place India's most expensive office market, ranks 9th globally More.

Reliance Jio Prime vs Airtel, Vodafone, Idea 4G offers Reliance Jio plans to bring 5G internet to your smartphones Maruti Suzuki opens online booking for Baleno RS India Inc to get 9. Reliance Jio new offer: News You Can Use. These are the 9 most expensive residential areas in Delhi People in these countries pay a lot more taxes than Indians These are the world's top 10 women bankers More.

Govt makes Aadhaar mandatory for opening bank accounts. Here's how it could be misused How daily price revision of petrol and diesel will impact you Here's why GST would be a headache for the govt in early days More. ECONOMY CORPORATE MARKETS MONEY INDUSTRY TECH OPINION PHOTOS VIDEOS MAGAZINE PROPERTY.