Stock option expense forfeiture rate

This section provides overviews of expense option types, estimating forfeitures, and repricing awards and discusses how to run the FAS Option Expense report. FAS Option Expense. Run the FAS Option Expense report STFS to calculate option expenses. In compliance with FAS R, PeopleSoft Stock Administration allows you to use four combinations of accounting distribution and valuation methods to expense options:.

Restricted Stock (Accounting For Issuing & Forfeiture, Unearned Compensation & Expense, FMV)Single valuation method with ratable distribution. Single valuation method with straight-line distribution. Multiple valuation method with ratable distribution.

Multiple valuation method with straight-line distribution. PeopleSoft Stock Administration does not support the accelerated attribution method for expensing options.

How to Account for Forfeited Stock Options | The Finance Base

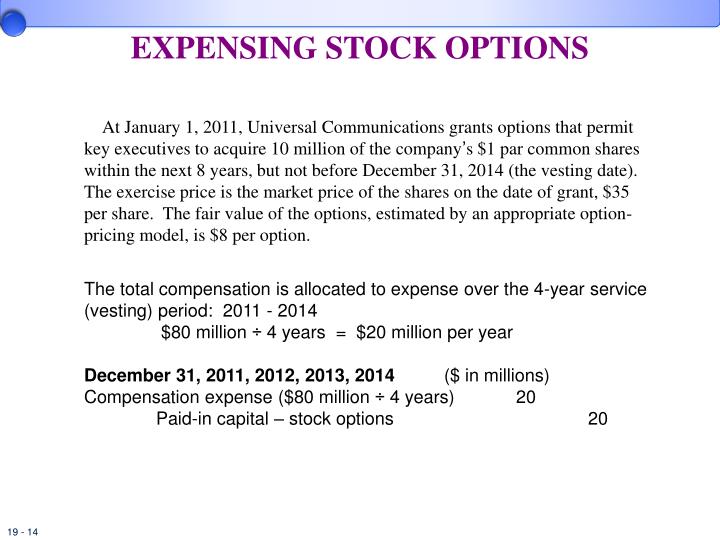

Under FAS R, stock option grant expenses must initially be calculated using a forfeiture estimation and the expense recorded must later be reconciled based on actual forfeiture outcomes. When a grant vests, the total of expenses taken over time must be equal to the grant's value. Similarly, if an employee terminates or otherwise forfeits an unvested grant, the total of expenses taken over time must be equal to zero.

Expensing Stock Options

In every expense period, the expense to date for some grants will be based on a forfeiture estimate, while the expense-to-date for others will not because they reflect vesting and forfeiture events in the period. The Estimated Annual Forfeiture Rate is used to estimate the annual percentage of currently unvested, granted shares that are expected to be forfeited prior to vesting.

The rate can be changed from period to period based on experience and events in order to maintain estimation accuracy. The system assumes that the full estimated forfeiture percentage applies at the beginning of the life of a grant and then decreases towards zero as the grant's vest date approaches in order to accurately calculate the estimated rate.

Under FAS R, expenses for repriced shares are calculated using a fixed amount of additional expense. The incremental cost for repriced awards is the excess, if any, of the fair value of the modified new award over the fair value of the original cancelled award immediately before its terms are modified. When re-valuing the original award at the cancellation date, the term is based on the remaining original term.

Worldwide Enterprises' stock price subsequently declines and by December 31, , the options are underwater. On that date, Worldwide Enterprises reprices the options by canceling them and granting replacement options priced at the current market value of the stock.

Online Tutorial #6: How Do You Calculate The Cost of Employee Stock Options?

The repricing expense for Worldwide Enterprises under FAS R are determined as of the date the replacement options are granted and, except for forfeitures, are not adjusted further. In addition, the company must determine the incremental expense for the replacement options. The incremental expense is the difference between the fair market value of the replacement options and the underwater options at the time they are cancelled.

This example illustrates the FAS Option Expense page. Enter the beginning date and ending date for the expense period for which the report is to be run. The date will determine which grants are included in the report. The system does not include in the report grants that are fully vested before the start date or grants with a grant date later than the end date.

Run separate reports for the period that you use APB 25 as your accounting standard and the period that you use FAS as your accounting standard.

Running the report for dates that straddle the two accounting standards does not produce appropriate results.

Select the expense type: Select this check box to limit the fields displayed in the report. Select the method used to calculate the value of shares within a grant:.

Uses one valuation for all shares within a grant. Uses different valuations for each valuation period. Select the distribution method used to calculate attribution expenses:.

The entire grant is expensed in a straight-line fashion. Each vesting tranche is expensed in a straight-line fashion, which accelerates expenses. The estimated percentage of shares per year that will likely not vest over the life of the grant.

Expensing Stock Options This section provides overviews of expense option types, estimating forfeitures, and repricing awards and discusses how to run the FAS Option Expense report. Option Expense Types In compliance with FAS R, PeopleSoft Stock Administration allows you to use four combinations of accounting distribution and valuation methods to expense options: Estimating Forfeitures Under FAS R, stock option grant expenses must initially be calculated using a forfeiture estimation and the expense recorded must later be reconciled based on actual forfeiture outcomes.

Expensing Repriced Awards Under FAS R, expenses for repriced shares are calculated using a fixed amount of additional expense. Navigation select Stock, then select Valuation, then select FAS Option Expense.

FAS Option Expense page This example illustrates the FAS Option Expense page. Start Date and End Date. Select the method used to calculate the value of shares within a grant: Select the distribution method used to calculate attribution expenses: Estimated Annual Forfeiture Rate.