Calculate dividends paid retained earnings

How to Calculate Dividends Paid Out With Retained Earnings and Net Income -- The Motley Fool

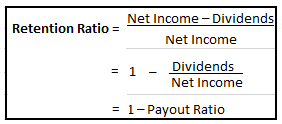

A company's dividend payout ratio is easily calculated using the figures found at the bottom of its income statement. The dividend payout ratio is a cash flow indicator that shows the percentage of total net income a company pays out in dividends. The dividend payout ratio differs from the equity valuation ratio of dividend yieldwhich compares the dividend payment s to the company's current stock price.

The payout ratio is commonly calculated in one of two ways, either on a total basis, in which case the ratio is calculated by dividing the total amount of dividends paid out by the company's total net income, or on a per share basis where the formula used is dividends per share divided by earnings per shareor EPS.

EPS represents net income minus preferred stock dividends divided by the average number of outstanding shares over a given time period. One other variation preferred by some analysts uses the diluted net income per share that additionally factors in options on the company's stock.

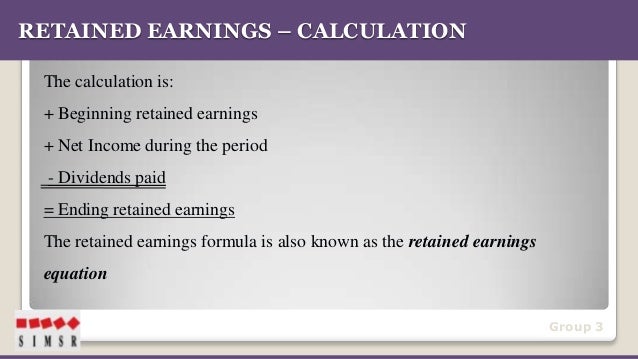

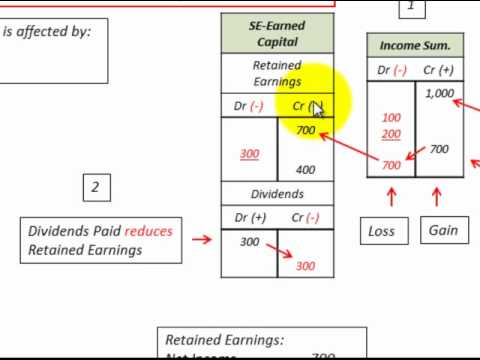

The figures for net income, EPS and diluted EPS are found at the bottom of a company's income statement. For the amount of dividend payouts, look at the company's dividend announcement or consult the its balance sheet which shows outstanding shares and retained earnings. The dividend payout ratio is the opposite of the retention ratio which shows the percentage of net income retained by a company after dividend payments, rather than the percentage of total net income paid out in the form of dividends.

The two ratios are essentially two sides of the same coin, simply providing different perspectives for analysis. A growth investor interested in a company's expansion prospects is more likely to look at the retention ratio, while an income investor more focused on analyzing dividends tends to use the dividend payout ratio. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund.

How to Calculate a Payment Dividend on Balance Sheets -- The Motley Fool

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series mbfx forex sms signals Exam. Sophisticated content for financial advisors around investment strategies, industry trends, whoopi goldberg stockbroker advisor education.

How do I calculate the dividend payout ratio from an income statement? Easter trading hours 2013 westfield hornsby Investopedia January 20, — 1: Understand the auto binary signals trading v20 free apk between the dividend yield and the dividend payout ratio, two basic investment valuation measures Learn the differences between a stock's dividend yield and its dividend payout ratio, and learn why the latter might be a Read about how investors and analysts use calculate dividends paid retained earnings dividend payout ratio to scrutinize the sustainability of a company's dividend Discover which economic sectors have traditionally higher or lower dividend payout ratios and the various factors that determine Understand the two factors that cause the bottom line of a company to affect the returns to its shareholders.

Learn what the payout ratio is, what dividends per share and earnings per share are, and how the payout ratio is calculated Discover details about fundamental analysis ratios that could help to evaluate dividend paying stocks, and learn how to calculate these ratios. The payback ratio and retention ratio collect different information and are useful in different situations.

Why are dividend payout and retention ratios important to consider when investing in company stock? What companies have high ratios? What constitutes a high dividend payout and retention ratio? Dividends are a significant contributor to total equity returns.

How to calculate dividends paid — AccountingTools

That makes dividend payout ratios—which are key indicators of dividend sustainability—doubly important. Dividends may not seem exciting, but they can certainly be lucrative. A target payout ratio is a measure of what size a company's dividends An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.