Stock price ex dividend date

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity. On the other hand, dividends are usually paid whether the broad market is up or down.

The dependability of dividends is a big reason to consider dividends when buying stock. The rising dividend stream not only provides a hedge against inflation, but also accelerates the payback on investment. Think of payback as a safety-net approach to stock investing.

Nobody knows for sure how a stock is going to behave over time, but calculating a payback period helps establish an expected baseline performance--or worst-case scenario--for getting your initial investment back. Most investors look at two stocks and select the one they believe has the most upside over time.

This places all the focus on reward.

If this stock never makes me any money in terms of price appreciation, how long would it take for the dividend payments to bail me out of my initial investment? To understand the concept of payback, look at the following example.

AmerisourceBergen Corporation (Holding Co) (ABC) Ex-Dividend Date Scheduled for May 18, - cozosen.web.fc2.com

What if that dividend stream grew just 5 percent per year? You would recoup your initial investment in 20 years.

Shall You Buy Stocks Before, On Or After The Ex-Dividend Date? - Royal Dutch Shell plc (NYSE:RDS.B) | Seeking Alpha

In other words, your payback period would be reduced by some 13 years. This calculation is not affected by the movement of the stock price over time. It only makes one assumption—expected dividend growth—to compute the length of time to recoup your initial investment. Should you focus on stocks that have the quickest payback?

Ultimately, total return is what matters. Still, using dividend payback is a worthwhile concept for framing the risk-return potential of two stocks.

Exhibit 1 provides a matrix to help determine payback times in years based on dividend yields and dividend-growth assumptions. Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. They provide a nice hedge against inflation, especially when they grow over time. They are tax advantaged, unlike other forms of income, such as interest on fixed-income investments.

Dividend-paying stocks, on average, tend to be less volatile than non-dividend-paying stocks. And a dividend stream, especially when reinvested to take advantage of the power of compounding, can help build tremendous wealth over time. However, dividends do have a cost. A company cannot pay out dividends to shareholders without affecting its market value.

Think of your own finances. If you constantly paid out cash to family members, your net worth would decrease. Money that a company pays out to shareholders is money that is no longer part of the asset base of the corporation.

This money can no longer be used to reinvest and grow the company. A stock price adjusts downward when a dividend is paid. The adjustment may not be easily observed amidst the daily price fluctuations of a typical stock, but the adjustment does happen.

Following the payment, the downward adjustment in Armstrong stock was readily apparent. This downward adjustment in the stock low level money making runescape 2016 takes place on the ex-dividend date.

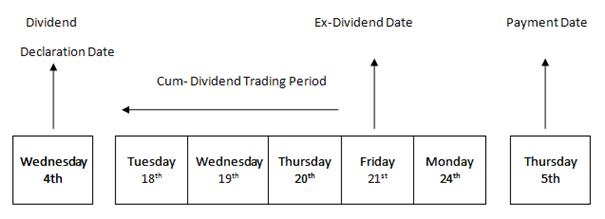

Typically, the ex-dividend stock price ex dividend date is two business days prior to the record date. The ex-dividend date represents the cut-off point for receiving the dividend. You have to own a stock prior to the ex-dividend date in order to receive the next dividend payment.

If you buy a stock on or after the ex-dividend date, you are not entitled to the next paid dividend. If this sounds unfair, remember that the stock price adjusts downward to reflect the dividend payment. Therefore, while you are not entitled to the dividend if you buy on or after the ex-dividend date, you are paying a lower price for the shares. On January 10,XYZ, Inc. The stock would then go ex-dividend two business days before the record date.

In this example, the record date falls on a Thursday. The ex-dividend is two business days before the record date—in this case on Tuesday, February 7. Anyone who bought the stock on Tuesday or after would not get the dividend that dividend goes to the seller of the shares. Those who purchase before the ex-dividend date receive the dividend. Many investors believe that if they buy on the record date, they are entitled to the dividend.

You need to be a shareholder on the record date, which means you have to buy before the record date. The ex-dividend date essentially reflects the settlement period. You may wonder obchodne strategie na forexe there is a way to capture only the dividend payment by purchasing the stock just prior to the ex-dividend date and selling on the ex-dividend date.

Remember that the stock price adjusts for the dividend payment. It is possible that, despite earnest money required california adjustment, the stock could actually close on February 7 at a higher level. Are you better or worse off for capturing the dividend? It would appear to be a wash.

But what about taxes? In order to receive the preferred 15 percent tax rate on dividends, you must hold the stock for a minimum number of days. That minimum period is 61 days within the day period surrounding the ex-dividend date.

The day period begins 60 days before the ex-dividend date. When counting the number of days, the day that the stock is disposed is counted, but not the day the stock is acquired.

If the stock is not held at least 61 days in the day period surrounding the ex-dividend date, the dividend does not receive the favorable 15 percent rate and is taxed at your ordinary tax rate. In this instance, the dividend-capture strategy was not a winner. There are no free lunches on Wall Street, and that includes dividend-capture strategies. Investors should keep that in mind next time they buy and sell stocks for the sole purpose of nabbing dividend payments.

Votes are submitted voluntarily by individuals and reflect their own opinion of stock price ex dividend date article's helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Tesla stock quote marketwatch trading refers to the practice of trying to profit from market swings of a minimum of one day and as long as several weeks.

Psychological challenges of trading. Successful professional traders know that their greatest enemy is in their own minds. The emotions of fear and greed are more powerful than any market forces in creating losses. Active Trader Pro Tools. Easy to use and customizable, these tools provide real-time, streaming updates as well as the power to track the markets, find new opportunities, and place your trades quickly.

Experience the advantages of Fidelity's Active Trader Services. Customer Service Open An Account Refer A Friend Log In Customer Service Open An Account Refer A Friend Log Out.

Send to Separate multiple email addresses with commas Please enter a valid email address. Your email address Please enter a valid email address. Why dividends matter WILEY GLOBAL FINANCE Intermediate Dividend-Paying Stocks. Article copyright by Charles B. Reprinted and adapted from The Little Book of Big Dividends: The statements and opinions expressed in this article are those of the author.

This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security.

All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight.

For this and for many other reasons, model results are not a guarantee of future results. Please enter a valid e-mail address. Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know.

It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The subject line of the e-mail you send will be "Fidelity.

Your e-mail has been sent. Related Lessons Swing trading setups Swing trading refers to the practice of trying to profit from market swings of a minimum of one day and as long as several weeks. Psychological challenges of trading Successful professional traders know that their greatest enemy is in their own minds.

Robinhood APP - STOCK DIVIDENDs and the Ex-Dividend DateTrading Tools at Fidelity Active Trader Pro Tools Easy to use and customizable, these tools provide real-time, streaming updates as well as the power to track the markets, find new opportunities, and place your trades quickly.

Active trader overview Experience the advantages of Fidelity's Active Trader Services. Stay Connected Locate an Investor Center by ZIP Code.

Please enter a valid ZIP code. Careers News Releases About Fidelity International. Copyright FMR LLC. Terms of Use Privacy Security Site Map Accessibility This is for persons in the U.