Projected return on stock market

Money A2Z

This month, the Journal of Portfolio Management published "Occam's Razor Redux: Establishing Reasonable Expectations for Financial Market Returns. Authored by Jack Bogle and Michael Nolan Jr.

Both of those figures are in nominal terms--that is, they are not adjusted for inflation. The article's bond model is simplicity itself: The yield to maturity on year Treasuries was 2. A generous nudge, which can perhaps be justified by the addition of higher-yielding credit bonds. As today's year Treasury yield is 2. It contains three terms. In creating his models, Bogle took his cue from John Maynard Keynes.

Keynes stated that the best economic models use few factors, with effects that are clearly understood. For example, he wrote, stock returns could be decomposed into two sources: Bogle directly adapted Keynes' framework.

Why long-term U.S. stock returns look dismal - MarketWatch

John Maynard Keynes AP Photo. This enterprise and speculation structure can be also be thought of as proceeds and valuation. Stock owners directly receive dividends and indirectly own part of corporate earnings. Those are the proceeds.

What Stock-Market Return Should Your Financial Plan Assume? - The Experts - WSJ

In addition to these items, which are somewhat under the control of companies which are buffeted by many economic influences, so the control is only a loose oneshareholders will gain or lose because of other investors' perceptions. The public may warm to the stock, thereby delivering a gain, or may become less fond of it, causing a loss.

That movement lies outside of corporate controls. For the market as a whole, enterprise results are easier to forecast than are speculative results. There are exceptions among companies: Young, emerging businesses may have highly unpredictable revenues, and highly leveraged and cyclical companies can suddenly plunge into bankruptcy.

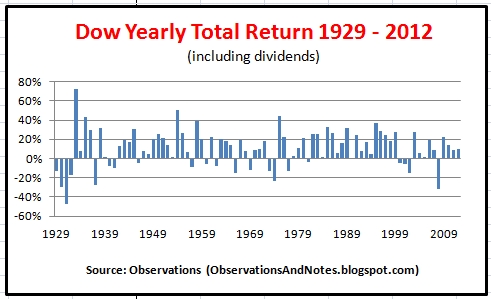

For the most part, however, dividend yields and earnings are fairly stable from year to year--particularly when aggregated into a market total. Speculative results, on the other hand, can fluctuate wildly. Bogle knew that the speculation term might be trouble when he debuted his Occam's Razor model 25 years ago, in "Investing in the s. Sure enough, the gap was chris moneymaker hollywood casino columbus almost entirely to the second term.

Bogle had estimated an annualized gain in the s of The model--and his article--was blindsided. But, as Bogle and Nolan no doubt are delighted to point out in the current article, the model had the last laugh. That December projected return on stock market was a peak.

By the end roles and functions of the zimbabwe stock exchange Maystock returns had retreated to Bogle's projected level, returning The model was far from the mark over a decade, but spot on for 12 and a half years. Formally, the relationship between Bogle's year stock forecasts and subsequent market returns is 0. The even-simpler bond model has an even-higher correlation of 0.

Greater complexity does not necessarily mean greater sophistication; as Mark Twain wrote, sometimes people compose long letters because they lack the time--and perhaps the skill--to draft a short one.

Thus, the evidence suggests that while Bogle's forecasts aren't reliable guides for a single, specified time period, they will likely be close to the mark free forex demo contests a sufficiently long term. As usual, stocks offer less certainty. But it is also very easy to envision scenarios that fall short of Bogle's estimate. Bogle's models don't touch on the subject of inflation, nor will this column--except to note that bond yields implicitly forecast low future inflation.

Stocks would lync 2013 call forwarding missing course fare better yet.

The historic premium offered by stocks over free clickbank autopilot money making software has been 4. That would springfield livestock market report a modest relative advantage for bonds.

On the other hand, because bond yields are so depressed, the ratio of stock-to-bond returns is not particularly low. In addition, Bogle and Nolan find no relationship between forecast equity premiums and future stock returns. A high premium, a low premium Thus, Bogle and Nolan do not interpret their findings as suggesting that investors might wish to change their asset allocations. They kick the can down the road, then down the road again. Entering this year, the median return assumption used by public pension funds not that private funds were much better was 7.

As my father would say, the chance that they will achieve that is slim and none, and slim left town 10 minutes ago. The speculative term might continue to work in pension funds' favor, as it mostly has over the past decade, so that they can continue to boot the can.

But ultimately it will subside, and pension funds will finally be forced to face reality: They're not going to make it. They will not gain 7. That's not going to happen. Read the original article on Morningstar. Tech market is nowhere near the dotcom days.

How augmented reality is changing the way we work. You are using an outdated version of Internet Explorer. For security reasons you should upgrade your browser. Please go to Windows Updates and install the latest version.

Trending Tech Insider Finance Politics Strategy Life Sports Video All. You have successfully emailed the post. Enterprise and Speculation In creating his models, Bogle took his cue from John Maynard Keynes. John Maynard Keynes AP Photo This enterprise and speculation structure can be also be thought of as proceeds and valuation.

The Lesson of the 90s Bogle knew that the speculation term might be trouble when he debuted his Occam's Razor model 25 years ago, in "Investing in the s. Takeaways 1 Expect low nominal returns from both stocks and bonds. Wall Street's brightest minds reveal the most important charts in the world. Scientists overlooked a major problem with going to Mars — and they fear it could be a suicide mission. Recommended For You Powered by Sailthru.

Thanks to our partners. Registration on or use of this site constitutes acceptance of our Terms of Service and Privacy Policy. Disclaimer Commerce Policy Made in NYC.

Stock quotes by finanzen.